Money is a very sensitive topic for almost everyone. When customers newly open a bank account, they are skeptical and already second-guess the bank. It’s the bank’s job to take away the skepticism through their onboarding process.

According to McKinsey research clearly shows that we need to reimagine the banking customer experience. Onboarding and resolving an issue play a major role in decision-making for a customer to stick around at the bank.

Customer onboarding in banks is the moment of truth. It’s the initial interaction that sets the tone for the entire relationship between the bank and its user. The onboarding process is the bank’s only chance to demonstrate its value to customers. Anything less than a good onboarding experience will drive away new customers, which will affect revenue and cause bad brand perception. In this blog, we’re going to learn how to simplify the customer onboarding process.

Why Is Customer Onboarding Important for Banking?

As we said earlier, customer onboarding sets the tone for the entire relationship between the bank and the users.

It involves integrating new users into the bank’s system and proving their legitimacy to prevent money laundering and fraud. This includes regulatory compliance like KYC (know your customer) procedures, ID verifications, and personal document collection (name, address, age).

The customer onboarding process also involves equipping users with knowledge and tips that’ll help them reach their “aha! Moment” and shorten time to value. This includes using product tours to guide users, providing credit or debit cards, and offering a self-service knowledge base so users can also help themselves when they have any issues.

A great and seamless onboarding process not only increases customer satisfaction and reduces time to value, but it also ensures compliance with necessary legal and regulatory checks.

Primary obstacles to onboarding customers

While customer onboarding is important in banking, it’s not without its challenges. Let’s look at some of the challenges that banks face when creating a frictionless customer onboarding process:

1. Disorganized processes

According to research by Deloitte, about 38% of customers drop off midway through the customer onboarding process. And one of the reasons why is because of the slow, disorganized process. The time it takes for a customer to go from the first stage to the last stage of onboarding is one of the most difficult challenges in running a successful onboarding process.

Why?

Customer onboarding in banking is different from every other industry because they’re dealing with money – it’s sensitive – so there’s a lot more at risk.

Each department in the bank (legal, operational, and credit) has rules and processes they need to follow. This means that a bank can have different department-specific processes that the customer needs to go through.

This process can frustrate the customers, especially when they are asked to submit the same information to different parties multiple times. And just like the Deloitte research predicted, when a customer is frustrated with the onboarding process, they’ll churn.

2. Data quality and verification concerns

Banks are required to adhere to strict regulatory and legal requirements, such as the Know Your Customer (KYC) regulations. While these regulations are there to prevent fraud and money laundering, they can also make the onboarding process complicated and unnecessarily lengthy, which can affect customer experience.

At the same time, data quality is also a big concern in the digital customer onboarding process.

According to O’Reilly, most organizations aren’t doing enough to address data quality issues. Only 20% of organizations have a dedicated data team. The rest just make do with inadequate tools and practices, which opens them up to a whole lot of risks like fraud.

3. Time constraints

Research shows that it takes approximately 34 weeks for banks to successfully onboarding a customer manually. That’s approximately 9 months!

It takes 9 months to have a baby!

It’s not shocking why it takes so much time. There are multiple departments in the bank with different processes. Also, there are multiple touchpoints involved in the onboarding process which also contributes to the lengthened time.

There is also no room for mistakes. A minor mistake in paperwork could cost the customer extra time because they’d have to start over. Such a tedious process.

4. Cultural factors

One of the biggest challenges with customer onboarding in banking is this ingrained mindset of “profit over customer experience”. And that needs to stop!

Banks should be more obsessed with their customers and switch to a more customer-centric culture.

In a more customer-centric culture, the customers become the main priority, and the onboarding process will be taken more seriously because it’s the first interaction a customer is having with the firm.

Building a customer-centric culture all starts with understanding your customers’ needs, preferences, goals, and pain points.

How?

According to Fahra Samreen, Lead business analyst at Inspira Enterprise, in a LinkedIn collaborative article, “To cultivate a customer-centric culture in banking, prioritize employee training in active listening and emotional intelligence. Share success stories, encourage cross-functional collaboration, and reward exceptional service to reinforce empathy. Use customer journey mapping and data analytics for personalized interactions. Regularly seek and implement customer feedback.”

5. Staff training and expertise

Banking regulations are always changing, so banks have to adapt their systems and operations to the regulations.

As their system and operations change, staff need to be constantly trained to familiarize them with the new processes and technology.

Also Read: Strategies to Enhancing Credit Union Member Experience

Benefits of Customer Onboarding in Banking

A well-structured, simplified customer onboarding process offers significant benefits for both banks and customers.

1. Assured value realization

Time-to-Value (TTV) measures the duration between the time a new customer gets onboarded and the moment they realize the value of your service.

Prioritizing great customer onboarding tools and enhancing the onboarding process with product tours or checklists can help shorten time to value and ensure new customers know the value and services the bank offers.

2. Enhanced customer loyalty

Customer onboarding is the most important part of increasing retention.

There are so many banks, and we all know how lengthy the process of opening a bank account is. If you can provide a better service than most banks and can meet the customer’s needs, you’ve got yourself a customer for life.

And one of the best things about loyal customers is the fact that they are also great brand ambassadors. Not only will they stick to the bank, but they will also tell everyone who has ears about the bank. Killing two birds with one stone.

3. Compliance confidence

As part of the customer onboarding process, regulatory and legal requirements (such as Know Your Customer (KYC) and Anti-Money Laundering (AML)) have to be adhered to. By implementing secure authentication methods such as biometric authentication and fraud prevention systems, banks can reduce (if not eliminate) fraud risks and protect customers.

Also Read: Guide on Compliance Training Program

4. Risk management to mitigate fraud

The customer onboarding process is lengthy and packed with a lot of tasks. It’s easier for compliance teams to identify high-risk customers – based on suspicious activities – before they strike and negatively impact the business.

Also, in customer onboarding (digital onboarding), there are digital identity verification technologies that are designed to detect any fraudulent ID documents and prevent any fraudulent application in real-time.

Digital identity verification is designed to detect fraudulent ID documents (e.g., passports, and driver’s licenses) and prevent application and identity fraud in real-time.

5. Improved customer experience

The experience of opening new accounts with most banks is excruciating – multiple submissions of the same documents, answering the same questions multiple times, and long wait time for verification before accessing the account.

With digital customer onboarding, the experience is way better – straightforward, non-repetitive questions and shorter wait time.

Also, customer onboarding creates an opportunity to educate new customers on how to use some complex bank features properly. There’s also the self-service knowledge base part where customers can look for any information they want at their own pace without having to wait for a customer service rep.

6. Cross-selling products/service

During the customer onboarding process, you’re collecting data about users to understand their financial needs, goals, pain points, and jobs to be done.

Once you’ve gathered all the necessary information about your customers, it becomes easier to personalize their onboarding experience and introduce them to additional products/services that are in line with the customer’s financial needs and preferences.

7. Minimize customer churn

Customer churn is the bane of any business’s existence. The customers are the heart of every business, including banks. No customer = no money = no business.

As we said earlier, during the onboarding process, you’re collecting data about your customers. Armed with this knowledge, you can find the right product fit for your customer needs and increase their chances of staying.

Check out our video on Knowledge Base for Financial Institution

How to Enhance Customer Experience with Client Onboarding Documentation

To improve customer onboarding experience, banks need to follow certain best practices:

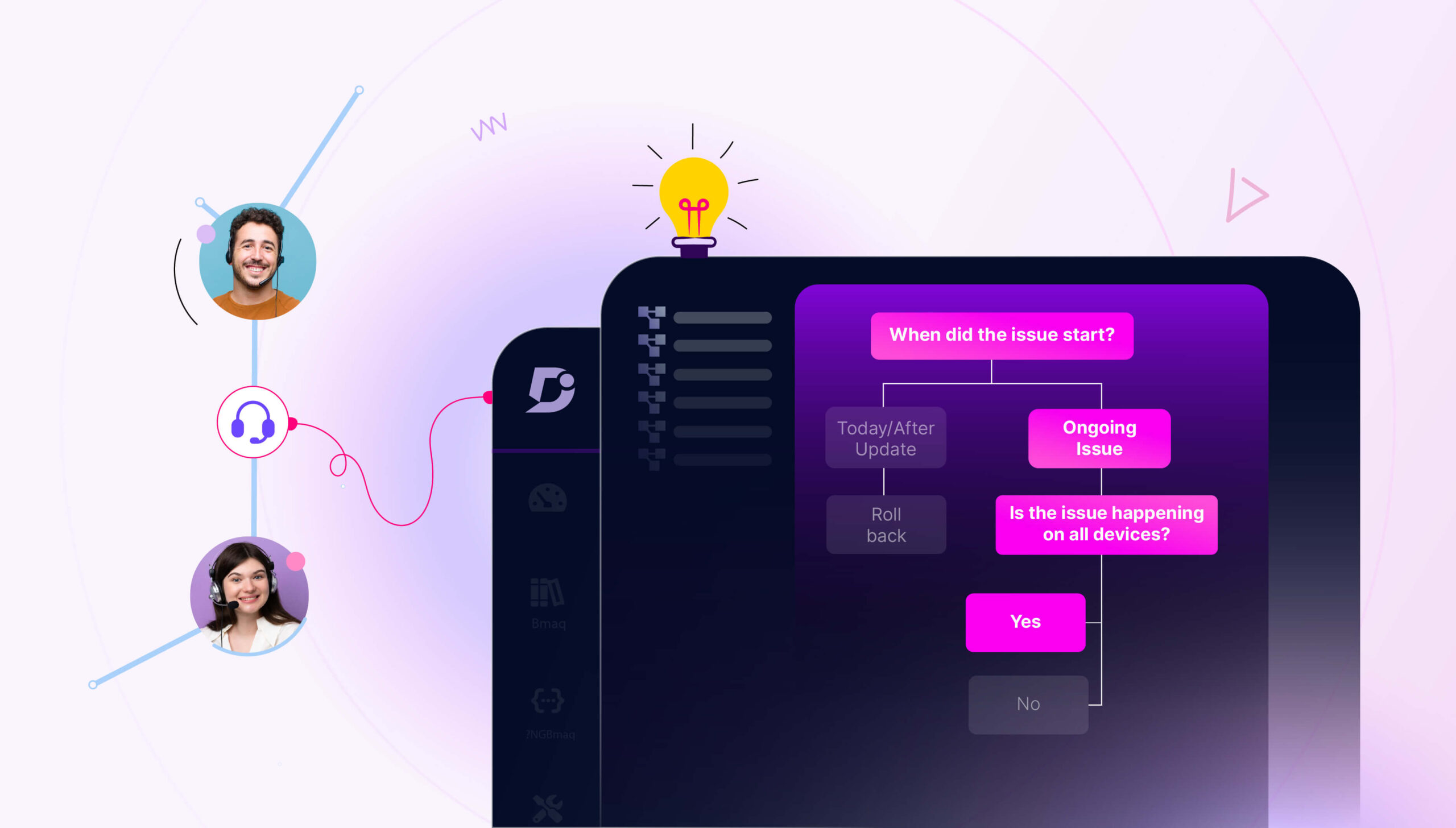

1. Step-by-step guidance for account opening

The best way to make sure that your customers have a seamless onboarding experience and they reach their aha! Moment faster is by guiding them through the onboarding process.

Use a personalized welcome screen to introduce customers to your platform and offer them the chance to get a product tour. Also, have tooltips in place to provide in–app guidance if they refuse the product tour.

Note: Tooltips are widgets that display brief information about how a feature works.

To make the onboarding experience more fun for your users, gamify the experience with checklists. Offer something in return for completing all the tasks on the checklist. This is a great way to get them to continue exploring the platform until they experience their “aha! Moment”.

2. Create a streamlined process

The onboarding process starts the second a customer opens an account. The mistake many banks make is overcomplicating the account opening process – this should be the easiest part.

Make signing up super easy so that anyone can do it. Stay away from asking any tough questions in the signup phase; if not, customers will churn.

You can offer bonuses, discounts, or other incentives to get your customers to quickly sign up and start the onboarding process.

For instance, Bank of America makes it easy to sign up, all you need is a few minutes. They even stated the duration of time it’ll take to complete sign-up – 10 minutes. As an incentive to make users sign up, they offer a $200 bonus for new checking accounts.

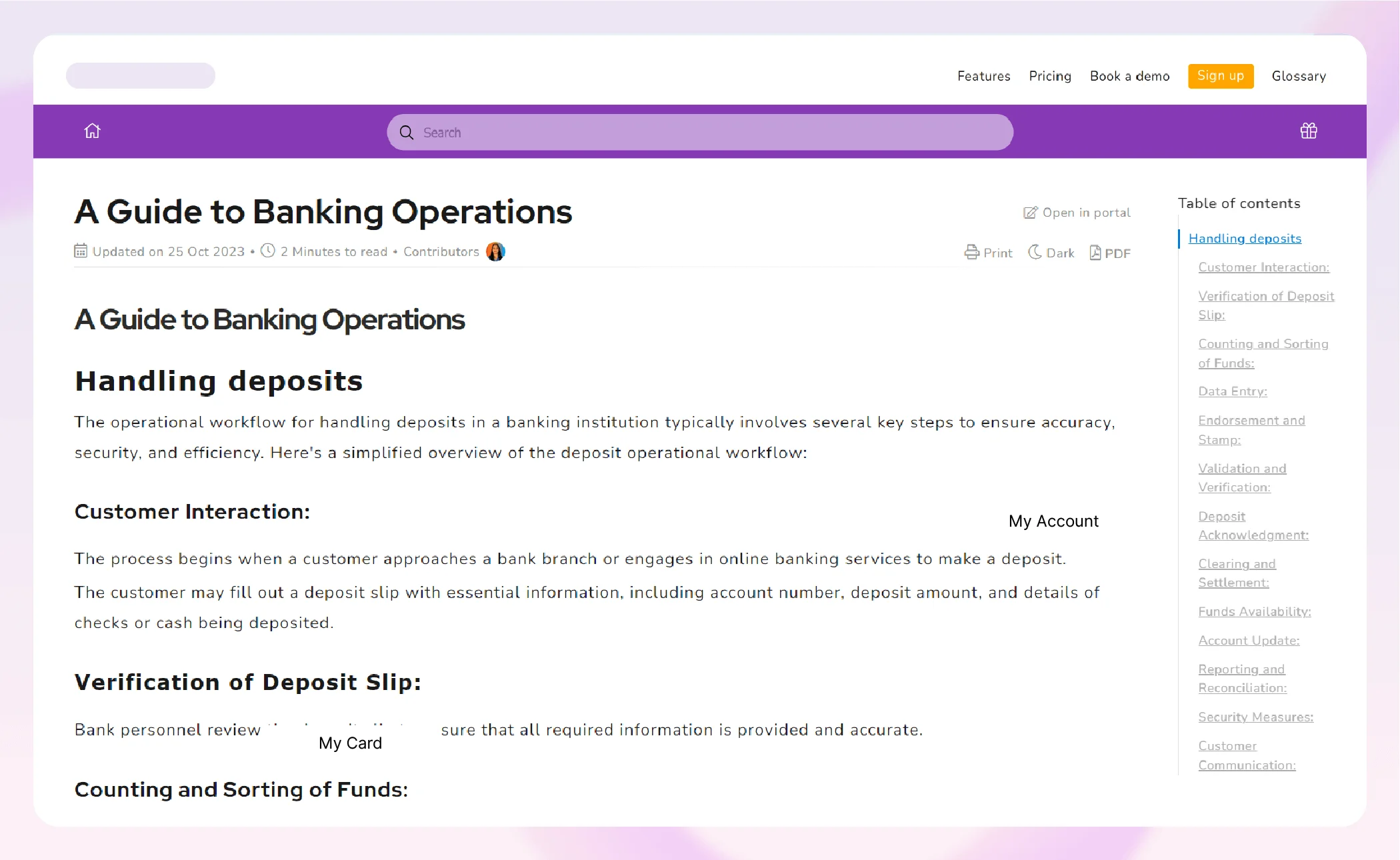

3. Detailed service information

The onboarding stage is not the time to hold back. You need to arm your customers with so much information about their new accounts and what your bank offers.

You can offer support through extensive guides, a knowledge base, a self-help portal, or a FAQ page to facilitate continuous onboarding.

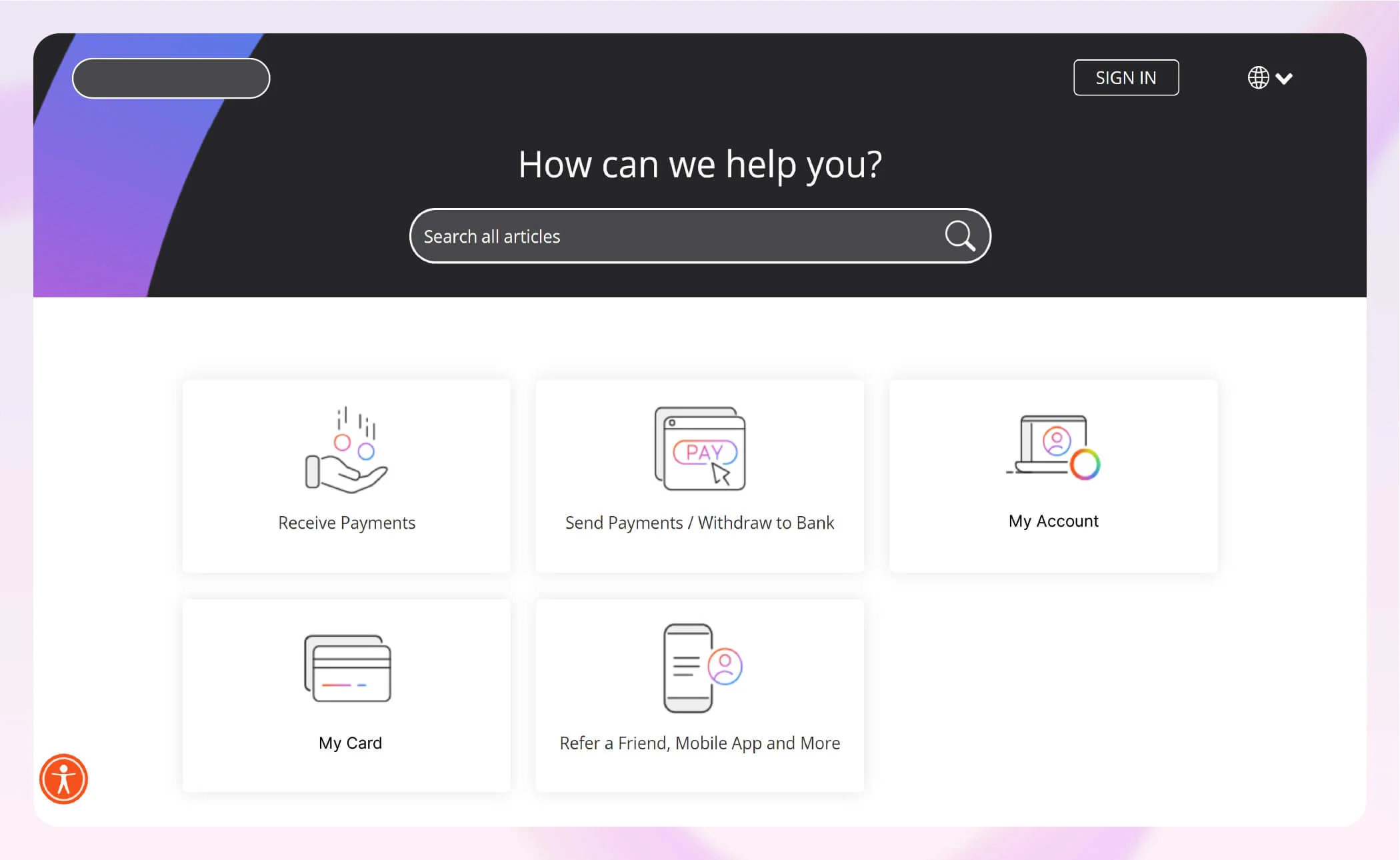

4. Provide 24/7 self-service support

As your customers grow, the load on your support team will be much cause there’s only so much a support team can handle. This will lead to lots of unattended tickets and, inevitably, churn. So, you need to invest in self-service support so customers can find solutions to issues on their own and don’t have to wait for a support agent.

Creating a customer knowledge base is the best way to enable your customers to solve their issues by themselves.

Document360 makes it easy to build a customer knowledge base with 24/7 support and add different content formats (videos, articles, documentation, etc) to make your content more engaging.

Book A Demo

5. Digital accessibility

It’s 2024, and no one wants to sit in long queues in the bank to open an account. Everything is digital now, so onboarding should be. Your customers should be able to open an account, onboard, and verify their identity digitally.

Also Read: How to Create Effective Bank Policy and Procedure?

Our Top Pick Customer Onboarding Tools for Banks

Now for the moment, you’ve been waiting for. Here are our top picks for customer onboarding tools for banks.

1. Document360

Now this might come off as a little biased (since we’re ranking ourselves first), but you’d see why it’s not in a bit.

Document360 is an AI-powered knowledge base platform that allows you to build, share, and manage self-service knowledge bases for your users and employees.

In the banking customer onboarding process, Document360 can be used to set up a self-service help center to effectively educate and onboard your new users and train employees on new regulatory policies.

The good thing about Document360 is that you don’t need any technical knowledge to get a grip on it, and at the same time, it also integrates with most of the popular help desk solutions (Intercom, Helpdesk, Zendesk) and you can integrate with any platform using Javascript. What makes Document360 stand out as the top choice for banks is its localization feature feature. Banks always cater to people of different ethnicities and languages. What’s cooler than offering help to them in the language they resonate with? That takes personalization to another level.

Document360 allows you to translate your knowledge base into different languages to cater to your international audience.

Here are the other features we have for customer onboarding in banking:

- Extensive analytics to understand end-user engagement with your knowledge base and find out which of your content customers are interested in.

- Advanced administration capabilities for team management

- Personalized knowledge base design to suit your bank’s branding.

Read our user story: See what our financial clients say about Document360 in managing information for their employees and customers.

2. Backbase

Backbase is a cloud-based solution that is designed to help financial institutions with customer onboarding, digital banking, user management, account openings, loans, etc.

The Backbase platform has several features, including:

- Credit card management

- Risk management

- Online banking

- Process and workflow capabilities to power onboarding journeys

- Localization to manage content in different languages

3. Creatio

Creatio is a platform to automate banking workflows and CRM with no code. Creatio offers a no-code platform (Studio Creatio), and a CRM platform which is divided into three different software: Marketing, Sales, and Service.

Studio Creatio is a no-code platform to automate workflows and build custom applications. The Sales and Marketing Creatio, just like the name implies, is for sales and marketing: Deal management, email campaigns, and lead generation. The Service Creatio is a no-code omnichannel platform to automate customer service workflows.

Features:

- Application hub and no-code designer. The application hub provides businesses with existing apps and templates. The no-code designer allows businesses to create workflows and software applications without coding.

- Automation features enable businesses to streamline processes and improve efficiency.

- Advanced analytics and reporting tools that help businesses gain insights into their customers and business performance.

Wrapping up

It’s not just enough to onboard customers; banks need to create great customer experiences that are regulatory-compliant.

How? By simplifying onboarding processes, embracing technology, and prioritizing your customers. And one more thing, by giving your customers the information they need. To be honest, there’s no onboarding without adequate knowledge. The difference between a good and bad onboarding experience lies in the depth of understanding. Did the customer reach their “aha! Moment” and understand the value of your service? If not, then you haven’t effectively guided them.

This is where Document360 comes in.

By investing in a self-service knowledge base, you’d bridge the gap between your customer and the value you provide. Customers can always go back to the knowledge base when they feel lost, reducing the burden on your customer service team. A win-win in our books.

–

–