A credit union is a type of cooperative financial service run by its members. It provides traditional financial services like bank accounts and loans, generally with better rates of interest. Although they might seem similar, credit unions are not banks. Unlike banks, credit unions are not-for-profit organizations and are exempt from paying taxes.

As with any financial service, easy access to important information is crucial. While customer service departments can play a role in assisting customers, many questions can be answered easily with a self-service knowledge base. More on this later.

Resolving more queries before they arise can drive efficiencies in your credit union. It shows that you have thought about customer problems and taken action to address them. Such an approach is especially helpful since you are dealing with members rather than customers—these members own a stake in the company. Since part of a credit union is members pooling their money to help others with loans, rewarding them with self-service options is a good way to distinguish your organization.

What is a Credit Union Knowledge Base?

Credit union membership is growing, with increases of 1.3% in 2023 for the number of total members in the UK. The total number of assets grew to £4.6 billion in the same period. Since credit unions typically have many fewer branches than banks, online and digital services are key to their success and growth.

It’s never too early to adopt a knowledge base in your credit union – although remember that security and privacy are paramount.

A credit union knowledge base is a self-service portal that contains information relating to the organization’s services and policies. Members can use it to obtain answers to their questions without contacting customer support, enabling the credit union to save money and reinvest more back into the business.

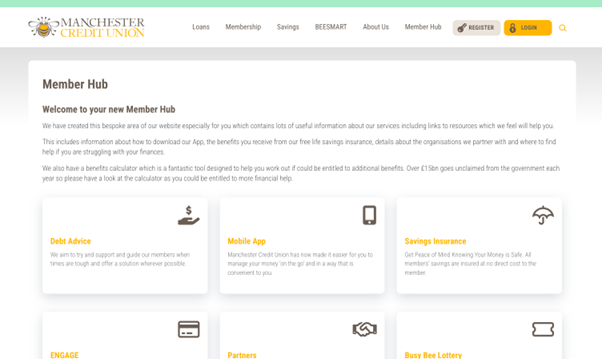

Here’s a great example of a credit union knowledge base for Manchester Credit Union:

It’s clear, concise and helpful. Links to each section make sense and guide customers towards the right information.

Since credit unions are both non-profit and located in the banking industry, your organization will have particular needs. Nonprofits must focus on giving back to members, while banking organizations must abide by the marketplace and follow financial regulations. A knowledge base can help with both these concerns.

Importance of Having a Knowledge Base for Credit Unions

Providing access to information is key here, and with digital knowledge base platforms so widely available there’s no excuse. For credit unions wishing to help customers or support employees, a knowledge base is essential. We’ll look at why now.

Members are Empowered with Self-service

If you offer customers self-service, members will feel more like you care about them. Articles in your knowledge base can answer questions far more quickly than expecting customers to wait for an agent, especially if your team is small. As a cooperative, any initiative that focuses directly on helping members aligns with your organizational values.

Effective Onboarding Process

You can automate the banking onboarding process with a self-service knowledge base containing training materials, tutorials, and guides. When members join your organization, they can turn to your knowledge base for help and get through this stage much more quickly. New members may be unaware of particular perks and benefits, but a knowledge base can tell them everything they need to know during onboarding.

Easily Train New Employees

Similarly to onboarding, your credit union’s employees need to constantly learn about policies, procedures, and other important workings of your organization. The knowledge base can be used internally to train employees on an ongoing basis so they are competent enough to serve your customers. Investing in your employees is one of the keys to improving employee retention, boosting employee morale, and embedding a positive culture.

Higher Member Satisfaction and Retention

In the US, members of credit unions are 1.5 times more likely to report that their institution cares about their financial well-being than members of a traditional bank. Members are less likely to consider an alternative institution if you offer them a high level of service through a self-service knowledge base. If your credit union can retain customers, it can grow and offer more profitable products that, in turn, attract future customers.

24/7 Availability of Information

The biggest problem financial institutions face in attracting new customers away from their current provider is inertia. In short, customers are too apathetic to leave an institution they are familiar with. This means offering a superior experience is one of the keys to acquisition as a growing credit union. If a member has a question in the middle of the night or they are contacting you outside of normal business hours, the information within your knowledge base is always available. It could be the difference between a fleeting interest and a new customer.

Reduces Risk and Errors

Standard operating procedures (SOPs) are required for many industries. Since every employee has access to the same information in an internal knowledge base, you can reduce the risk of errors by ensuring everyone stays well-informed. You can also make your operations more consistent by explicitly documenting your policies and procedures and making them readily available. Replacing “tribal knowledge” with corporate accountability is key to reducing errors.

Ensures Legal Compliance

Financial institutions are particularly in need of a knowledge base as they are subject to stringent regulations. Since you’re dealing with financial matters, the information you share must be clear and accurate. You can set reminders to regularly review your content to ensure it is up-to-date, assigning particular authors to revise articles. Choose a knowledge-based solution that is also compliant with local regulations such as the GDPR.

Reduces Call Volume and Wait Times

The more customers you have, the longer your wait times in your call center are likely to be. Answering customer queries automatically reduces call volume and wait times. Customers are more satisfied with instant and accurate answers versus waiting on hold and, therefore, happier with your service.

Helps Reinvest Money Back into the Business

High acquisition costs mean that it can take credit unions up to two years to profit from a new customer. Since credit unions typically operate with a more limited budget than traditional banks (they don’t have investors), view your knowledge base as a powerful money saver. The more you save on customer support through reducing operational costs, the more you can reinvest back into the business to provide more value to members.

Interested in Creating a Knowledge Base for Your Credit Union? Schedule a demo with one of our experts

Book A Demo

Key Features of a Credit Union Knowledge Base

Knowledge bases for credit unions have some key features that distinguish them from other knowledge bases.

Manage Policies and Procedures Centrally

You should manage your knowledge base centrally and save your policies and procedures for easy reference. For example, your team should know how an agent should handle an account, procedures for dealing with fraud, and escalation policies. Just like any business, credit unions must operate consistently.

Offer Advanced Search Functionality

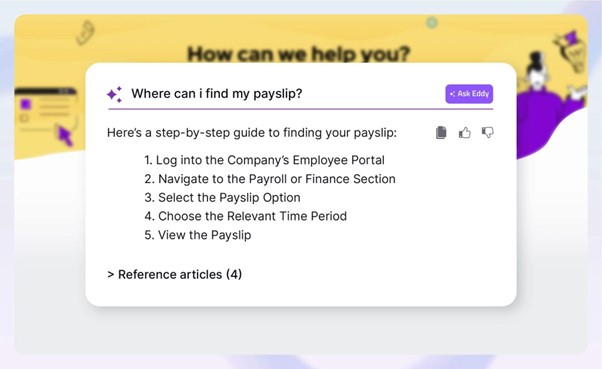

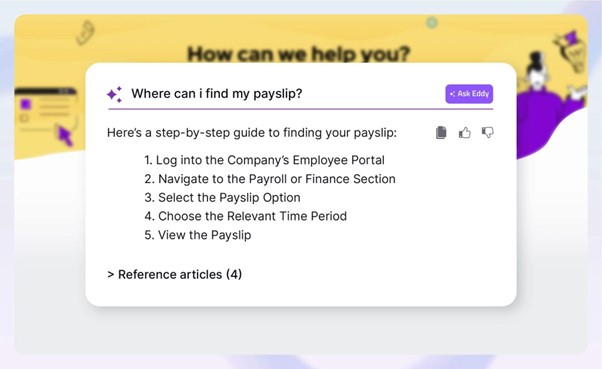

Whether customers or agents are using your knowledge base, advanced search is key for content discovery. AI features that intelligently scan your data for the right answers and suggest further information help with visibility. They make the information environment richer, and make customers aware of “unknown unknowns”.

Example of Ask Eddy feature in Document360 knowledge base

Mobile-friendly Design to Support Digital Adoption

In all likelihood, members will be accessing your knowledge base through their smartphones and tablets. This means a mobile-friendly and responsive design helps with the adoption of your resource – members will use it instead of clogging up the phone lines or your inbox. Consider how members will be contacting your business.

Seamless Integration with Existing Intranet or Portal

Businesses rarely use a single technology for their customer service. As a consequence, your knowledge base software should seamlessly integrate with your existing intranet or portal, so agents can customize workflows and avoid switching between tools needlessly. Take into account your whole software ecosystem when choosing a new tool.

Easy Documentation with Version History

Resources in your knowledge base change frequently, so it’s important to keep content up-to-date. Version history means you can track every revision of a page and revert to an earlier version if necessary. You can also control who has permission to make changes and see exactly who has made revisions.

Security Features are a Priority

Security features are a top priority for credit unions as part of the finance sector. Handling financial and other personal data means following the rules of your country or region. Following regulations for how data is handled and how software can be accessed means choosing the right software enables you to avoid future penalties.

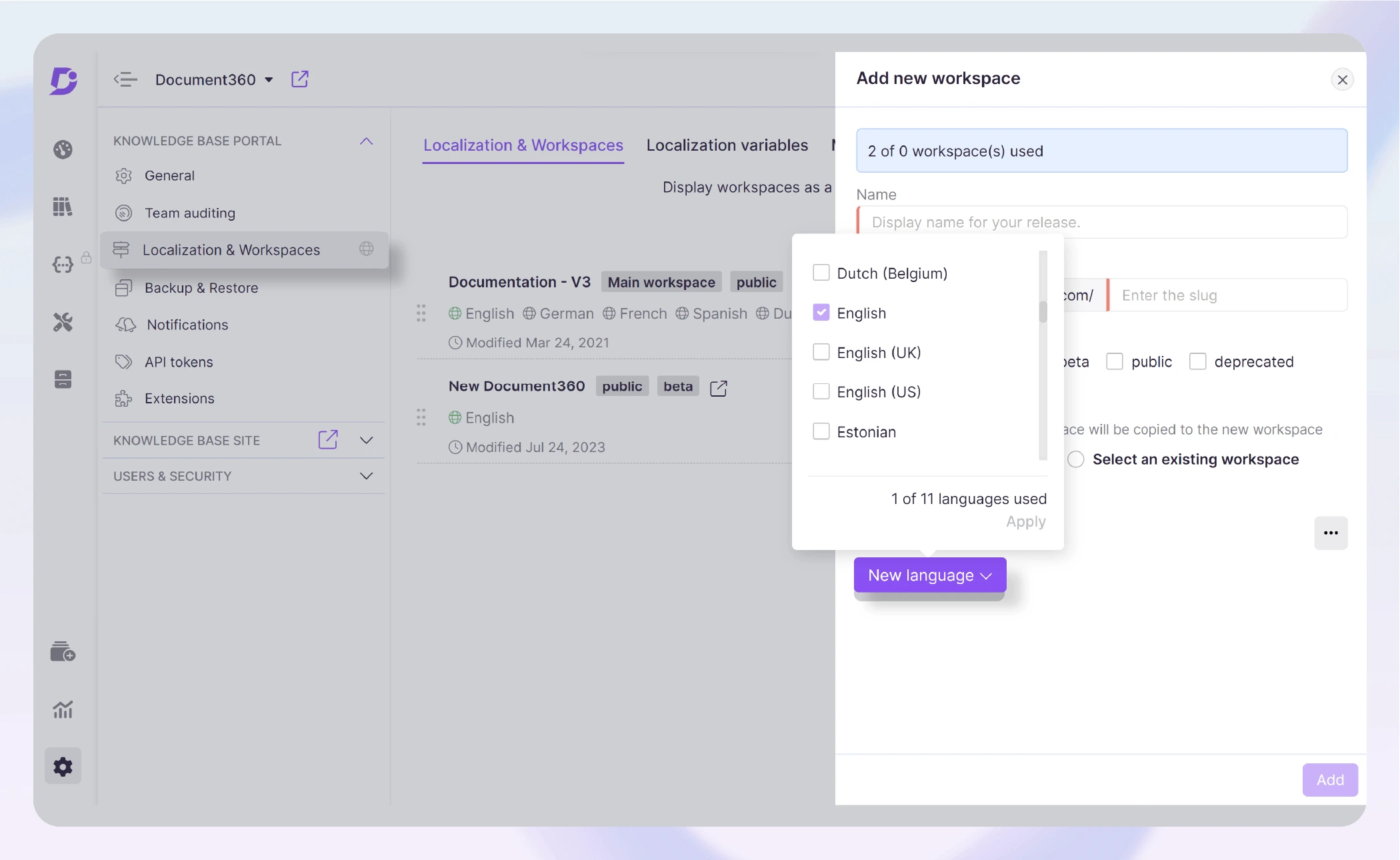

Multilingual Support

Credit unions, like banks, are likely to have a diverse customer base in multiple locales from many cultures. Providing a multilingual knowledge base is essential, with on-demand translation services for members who require a different language. Many knowledge bases are equipped with plugin translation services.

Example of localization feature in a knowledge base

Document360: The Right Credit Union Knowledge Base Software for Modernizing Operations

Credit unions must provide online resources for their members, including a helpful knowledge base with detailed information.

Document360 is your friend if you are a credit union seeking a knowledge base. As specialized knowledge software, Document360 has been developed to cater to companies that need to provide effortless technical documentation. Focus less on the tool and more on creating an exceptional content experience.

Credit unions favor Document360 because it’s easy to adopt and won’t break the bank for your non-profit. With Document360, you can control user access with advanced controls, whether that’s on the content creation or knowledge discovery side. With Document360, making changes and ensuring compliance in your sector is easy.Manage security with centralized administration that ensures your knowledge base stays public or private. Metrics mean you can analyze performance and usage so your knowledge base keeps improving. More customers don’t have to mean more hassle.

We have been using the Document360 Knowledge base for both our membership help guides & our internal process documentation. The ease of integration of the knowledge base to our membership web portal & management options is second to none. I would recommend Document360 as a first-class knowledge-based solution.

Jevon Cliffgard | Lead Software Architect, Corporate Central Credit Union

Tips for Creating and Maintaining a Credit Union Knowledge Base

Once you’ve set your knowledge base up, it will still require some ongoing maintenance from time to time. In fact, we’d argue that it’s absolutely critical for you to keep improving your knowledge base for your credit union.

Identifying Member Needs and Common Queries

Many credit unions target members who live in the same location or are part of an organization. This means your information needs to be highly targeted to your customer base. A knowledge base that meets member needs and answers common queries is crucial in providing this personal service, ensuring that you exceed the experience of traditional banks.

Regularly Updating Content with New Information

Regularly updating your knowledge base with relevant information keeps it helpful for members – many credit unions were posting content about the COVID-19 crisis and lockdown during the pandemic a few years ago, while their focus now is more on assisting members with the current cost of living crisis.

Ensure Easy Access for Employees and Members

It must be easy for employees and members to access the knowledge base, or they won’t use it. This means offering a simple login process while remaining secure, access across devices, and content that is indexed by search. It should be easier for members to use the knowledge base than to pick up the phone or fire off an email. AI and bots can help you serve relevant and contextual knowledge to members.

Monitor Member Usage and Search Analytics

You need to be realistic about the call volume your contact center can handle and adapt accordingly. A knowledge base can pick up the slack, so monitoring member usage and search analytics can help you decide what content to invest in. If you have a high bounce rate, for example, this could be a sign that your content needs improving.

Address Knowledge Gaps and Improve Usability

A knowledge base is not a static resource. Content should change and needs to be kept updated for the best usability. Repetitive queries being handled by your customer support team can tell you that you need to create new content to address a problem. The right software will help you create a knowledge base with good UX that looks modern.

Conclusion

Credit unions are thriving around the globe as customers increasingly turn to alternative institutions for their banking. Without a physical location, digital services and online customer service are essential for attracting and retaining customers and overcoming the pull of inertia for customers to stay with rival institutions.

A knowledge base created with a solution like Document360 is a powerful and cost-effective way to help customers. Write once, and use content, again and again, to answer questions or solve problems. When your goal is to reinvest profits back into the business, anything you can do for members is a plus.

Providing trustworthy help reassures members they have made the right choice in joining your credit union.

An intuitive knowledge base software to easily add your content and integrate it with any application. Give Document360 a try!

GET STARTED