When you think of client onboarding in wealth management, you may picture a white-glove onboarding scenario in which a financial advisor personally guides the customer through the setup process. While this may be the case, many wealth management companies are also using modern digital tools to support the onboarding process.

Being responsible for managing a client’s finances and investment portfolio is a very responsible job and requires the wealth management firm to create the highest level of trust. The financial aspect of the business is roughly equal to the importance of the relationship-building side, where the client and the company become partners.

Client onboarding is the first step to building this relationship and maintaining the reputation that your business has earned throughout the years. Providing and integrating the right information with your onboarding tools and processes is also integral to successful onboarding.

What is Client Onboarding in Wealth Management?

Client onboarding in wealth management is the process of getting new clients introduced to their financial advisors but also gathering all the information the business needs to work with the new client. Onboarding begins as soon as you discover a new lead during prospecting who might turn into a paying long-term client.

Client onboarding is composed of several steps:

- Set mutually beneficial goals – clients have different portfolios and aspirations, so what your firm will be able to do for an individual client will vary. Use the onboarding phase to establish these goals and set mutual expectations quickly.

- Collect key information – finding out more about the client is critical for a successful relationship and needs to take place during onboarding.

- Set clients up with digital tools – as well as having a one-to-one introduction, getting clients set up with digital tools such as customer onboarding documentation introduces clients to an element of self-service.

- Establish expectations – being clear with your client about exactly what your company can do for them and how much they can expect their wealth to grow.

With the rise of digital onboarding tools even penetrating the wealth management industry, clients expect more than ever for businesses to utilize technology alongside highly personal relationships.

Why Do You Need Client Onboarding in Wealth Management?

There was an estimated $103 trillion in global assets under management in 2020 (the last year for which data is available) and the industry is only growing. Although impacted during the 2008 financial crisis and the 2022 fallout from the pandemic, the wealth management industry is expected to grow and reach $147.3 trillion by 2027.

Boosts Confidence in Their Partnership With You

With such competition in the market, clients have more confidence in your business when you offer a robust onboarding process. Starting as you mean to go on, providing the right information, and demonstrating your expertise from day one are crucial to establishing trust. When you are responsible for a client’s assets, whether they be a bank, another institution, or an individual, clients need faith in your expertise and reputation.

Since new clients must be accepted by the relevant bodies, reducing or eliminating delays in the onboarding process will reduce client frustration and accelerate the time it takes for them to start investing in your business.

Competitive Advantage in the Market

With so many other organizations offering similar services and clients lacking an understanding of subtle differences, onboarding is a chance to distinguish yourself from clients. Creating astonishment and delight in clients, alongside assurance that you will effectively manage their wealth, helps improve the client relationship and create an advantage over your competitors.

Digitizing the onboarding experience means you can start delivering a superior service compared to competing institutions that may still be struggling with manual, paper-based processes.

Reduces Manual Errors

Automating the onboarding process with digital tools can reduce the chance of manual error since each step is predetermined. Offering the same experience for every customer in terms of digital platforms creates consistency and cements your reputation, which at the same time can be supplemented by the personal touch.

Delays from the clearing firms that approve clients negatively impact the customer experience and extend the amount of time you must spend onboarding. Eliminating manual error through a robust onboarding experience means you can increase customer satisfaction and accelerate onboarding.

Overcomes Operational and Compliance Risks

When managing something as important as a client’s wealth, there will always be operational and compliance risks that every wealth and investment advisor needs to understand. Onboarding demonstrates that your business will be compliant with the rules, so the client doesn’t need to understand anything more than necessary.

Standardizing the onboarding process is the first step towards compliance and minimizing the risk that the client will receive an outcome they don’t want. Clients may not fully understand the concept of wealth management, but onboarding ensures that they will be informed of the risks.

Helps you Gain Customer Trust and Satisfaction

In such a highly personalized and relationship-based industry as wealth management, you can gain client trust and satisfaction through onboarding. Showing clients that you value their business and demonstrating your expertise right away is possible through effective onboarding.

Since onboarding includes prospecting and product selection, client onboarding can help you with acquisition through attracting new clients. Making the right impression from the beginning is the first step to establishing trust.

Check out our video on Knowledge Base for Financial Institution

Steps to Achieving a Smooth Financial Client Onboarding Process

While each client onboarding process will be unique depending on your wealth management company, you can follow these consistent steps to implement onboarding smoothly. Forward planning and being intentional is key to successful onboarding, but so is being flexible enough to adjust the process as you go along and integrate learnings.

Step 1: Identify the Client Onboarding Journey

First of all, identify the journey that you want your client to take when onboarding with your company. What kind of impression do you want them to have of your business, and what key actions do you want them to take when learning about your services? The journey is broken down into distinct phases and requires you to put resources in place for clients to be successful and find answers to common queries.

Client onboarding can encompass parts of the journey, including prospecting and regulatory checks to ensure the client is suitable for your firm, so it is more comprehensive than a simple new account opening.

Even in the wealth management industry, clients must realize the value of your services as quickly as possible during onboarding, accelerating the time it takes to reach the “aha” moment. Following a client onboarding journey means that no client remains stagnant or misses out on vital support.

Step 2: Ensure Compliance with Regulatory Measures

Complying fully with regulatory measures is a big part of being a wealth management business. Clients expect you to take care of these aspects for them so they can relax and simply watch their wealth grow. Bots can also help you achieve compliance by completing requirements or submitting documents to the relevant regulators.

Assets managed by robo-advisors will reach $5.9 trillion by 2027, more than double the amount five years ago. AI is increasingly having an important role to play in wealth and asset management. Employing the use of AI for more routine tasks means wealth advisors have more time free for high-level tasks, including improving the onboarding process.

Manual paperwork involving tasks that previously took up a huge amount of time can now be eliminated through the use of automation. Wealth management can become more efficient and consistent for clients.

Step 3: Choose the Right Onboarding Software

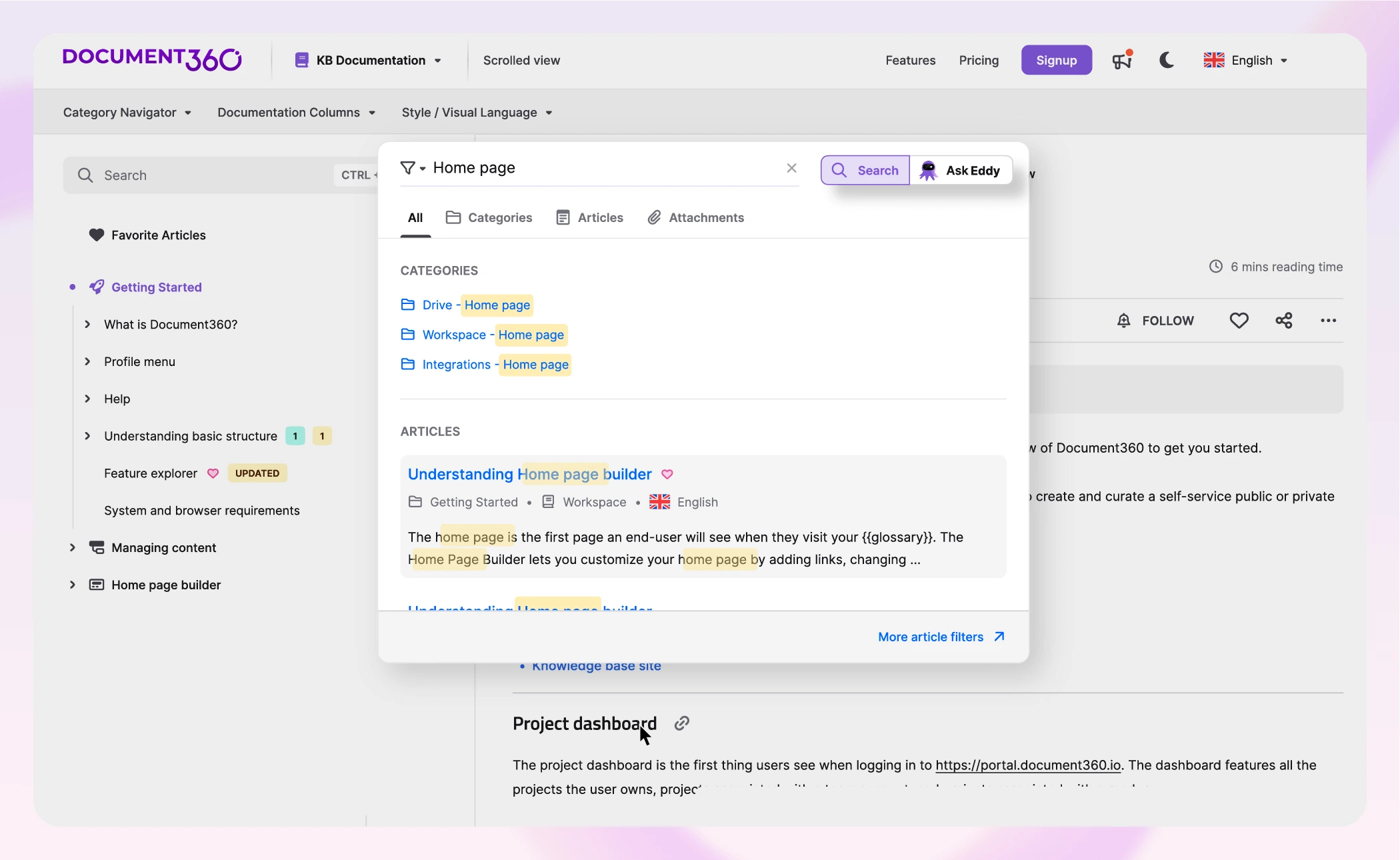

Choose onboarding software that perfectly suits your clients and business to create the best experience. You need to decide exactly how much of the process you want to automate and settle on a solution that has all the relevant features. Solutions such as Document360 can be your best friend here because you can create well-organized documents for the onboarding process. It offers an advanced portal for content producers with Markdown and Advanced WYSIWYG, which is designed for people with no coding experience to master creating online onboarding documentation.

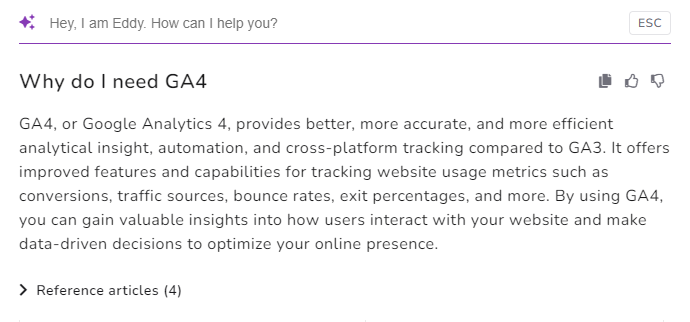

Document360 AI – The Eddy– will help you generate a content outline, assist in article titles, which allows you to choose or revise article titles, recommend tags to organize the documentation, and generate SEO meta description for the article. The AI-powered search will help users with accurate results in a fraction of a second. Additionally, it offers advanced analytics, version history, review reminders, and many more. It can be integrated with any platform using JavaScript.

Here is the case study of Abrigo– a financial Solutions provider that uses Document360 to set up documentation to help onboard their clients seamlessly.

You might develop your custom solution in-house or opt for a SaaS product that can be adapted to your own particular client needs. Decide on the UX you want and the particular experiences you want customers to have, such as checklists and completing documents to gather all the necessary information.

Other onboarding software can include e-signature solutions, document management platforms, and more. Anything that can digitize and automate the onboarding process is relevant here.

Schedule a demo with one of our experts to take a deeper dive into Document360

Book A Demo

Step 4: Enable Self-service for Clients

While wealth management clients appreciate access to their financial advisor or account manager, being able to solve some queries through self-service brings your business firmly into the twenty-first century. Self-service could be a comprehensively populated online documentation that provides common answers or a chatbot that detects customer intent and attempts to solve their queries.

Self-service means that clients solve problems themselves without having to seek human assistance. You spend a little time investing in support materials so that customers are empowered to learn for themselves about how your business works. Although many clients will prefer a personalized service, younger clients may just want a digital onboarding experience where they have more control over managing their wealth.

Step 5: Leverage AI for Support Assistance

More than 90% of asset managers are already using disruptive technological tools such as AI to improve the client experience, according to PwC. Companies that can demonstrate an aptitude to integrate these novel technologies to support clients increase the capacity and quality of the service they can provide.

Younger clients in particular expect digital and mobile-first experiences, which becomes more important as wealth passes from the boomer generation to their millennial children. It’s not so much that advisors will never be expected to offer support, but more that they will have to combine their personal services with technology such as AI.

AI-driven chatbots or AI assistants can support new clients with the more typical queries, ensure that clients have all the information they need, and guide them through the initial processes so they don’t need their hand held by an advisor. Today’s bots are intelligent enough to sense when a client needs to be transferred to an advisor, which means the support experience will be seamless.

Step 6: Set up Personalized Consultations for Complex Inquiries

As much as technology can help you with client onboarding in wealth management, personalized consultations are essential for the more complex inquiries where clients need to speak to an advisor. Especially high-net-worth individuals (more than $1 million) must have a personalized service with a designated advisor who takes them through their assets and goals.

You need to manage initial client expectations properly when consulting over their wealth management prospects, including what they can expect from potential growth. They need to understand the state of the market and possible risks when it comes to growing their assets, which an advisor can take them through.

Step 7: Collect Client Pain Points and Improve the Process

The client onboarding process is always evolving, and you can gather feedback from clients about their pain points with their experience of your company. A wealth management company that can respond to feedback distinguishes itself from competitors by being willing to change and meet client needs. Even automated onboarding tools can record where clients get stuck or report on missed parts of the checklists.

It will not be possible to retain every client since your business may not suit their needs, but you can increase your chances of connection by overcoming possible objections. Since onboarding a new client is so time-consuming and often fails if the paperwork contains errors, eliminating pain points is essential for managing resources.

Wrapping Up

Clients in the wealth management industry have high expectations from businesses, especially during the onboarding process. Combining the benefits of human and digital service helps support clients through this vital phase of the journey with your business and provides a better experience overall. Never miss an opportunity to connect with clients during onboarding.

The wealth management industry is only expected to grow, which means there will be more competition from new players and established businesses will have to make sure they keep up. Changing client expectations means that AI and other digital tools, including onboarding software, are becoming increasingly essential during onboarding.

Improving the onboarding process can win you, clients, for life who trust in your abilities to manage their assets.

–

–