Customers need banking processes to complete transactions quickly with no interruptions while avoiding errors. Banks require automation to keep their existing clients and achieve customer acquisition by improving digital systems and delivering reliable service quality. Many organizations continue to use old methods for managing critical documents, such as SOPs, compliance guidelines, and training materials, which exist in separate PDFs, emails, and shared drives. Such disorganized systems slow employees down, frustrate customers, and result in higher operational expenses.

Employee onboarding and customer support work more slowly because employees spend too many minutes trying to locate needed answers. The solution involves bringing all documents under a single centralized repository.

Modern documentation boosts agility: faster training for employees, reliable support, and lower costs. Maintaining old-fashioned business practices will lead to increased inefficiency, which diminishes trust and profit potential. Banking institutions must adopt advanced procedures for operational success in the future.

Why is Streamlining Banking Processes Important?

Banks face economic pressure since the Eurozone economy anticipates 1.5% growth this year, thus requiring them to optimize their operations to decrease their costs. Modern financial organizations must streamline their banking procedures because it enables better performance and helps satisfy clients while remaining competitive in the market. Here’s why:

Boosts efficiency

In banking, efficiency is everything. A seamless workflow enables both quicker transaction processing as well as prevents customer and staff bottlenecks during transactions.

A Canadian payment processor saw similar results after switching to a knowledge base. They reduced customer handle time by up to 8 minutes and saved internal resources through automated content management, boosting both team productivity and customer satisfaction.

Staff members deliver better customer engagement and financial advice because they no longer need to spend time on repetitive work, allowing them to concentrate on higher-value activities.

In short, streamlined banking processes deliver faster service, minimize errors, and lead to better performance for the financial institution as well as its users. It’s a win-win.

Lowers costs and improves service

Cost reduction is a key benefit. Manual tasks, like document verification, are slow and costly. Automation reduces errors and labor expenses. For instance, the average cost to create a mortgage rose from $5,100 in 2012 to $11,600 in 2023, but efficient banks did it for $6,900, saving 40%. European Bank Deutsche Bank’s operational efficiency saved $1.3 billion by streamlining processes.

The streamlining process delivers faster services so that loan approvals become quicker, thus decreasing customer wait times. By simplifying operations, banks save money, improve customer satisfaction, and stay competitive.

Reduces wait times and errors

Long wait times and system errors negatively impact both banking operations’ speed and customer satisfaction. The optimization of banking operations produces faster and more accurate transactions for customers.

Efficient processes also shorten employee training and help banks meet compliance standards. Improved speed and accuracy lead to higher productivity and customer loyalty.

Strengthens security and fraud prevention

Banking institutions prioritize security above all because defective processes expose weaknesses that hackers use to initiate fraud. Automated systems, powered by AI fraud detection, analyze data in real-time to spot suspicious activities. HSBC has implemented more than 550 artificial intelligence cases that combat both financial fraud and money laundering activities, thus proving that technological solutions can effectively fight crime.

AI models teach themselves through processed data that subsequently brings better consistency with each use. The system monitors user activities instead of traditional rules, which leads to greater difficulty for fraudsters. The automated system delivers better and faster fraud detection capabilities compared to human-controlled methods.

When systems are streamlined, security improves because data access is restricted exclusively to authorized staff members

Secure digital solution, together with reduced manual data handling, facilitates better bank protection of customer assets and minimizes risks in banking operations.

Banking operations streamlined through proper processes protect customers as well as maintain full regulatory compliance, thus resulting in safer banking systems.

Enables personalized services

The modern banking industry handles more than processing transactions since it actively develops meaningful interactions with customers. The system uses data series to customize financial solutions for customers. The upgraded workflows enable staff to establish connections with clients instead of spending time on administrative tasks.

AI analysis, together with automatic operational resources, generates customized financing deals, capital advice, and financial guidance from customer action patterns.

The system delivers accurate and personalized help to users at all times in a safe manner. Financial institutions achieve both customer satisfaction and lasting business expansion when they optimize their processes to provide individualized services. Hence, it strengthens customer retention and enhances customer-business relations.

Regulatory Compliance

The banking sector operates under strict regulatory frameworks to ensure transparency, security, and fairness. However, compliance can become a major challenge when processes are outdated, inconsistent, or overly complex.

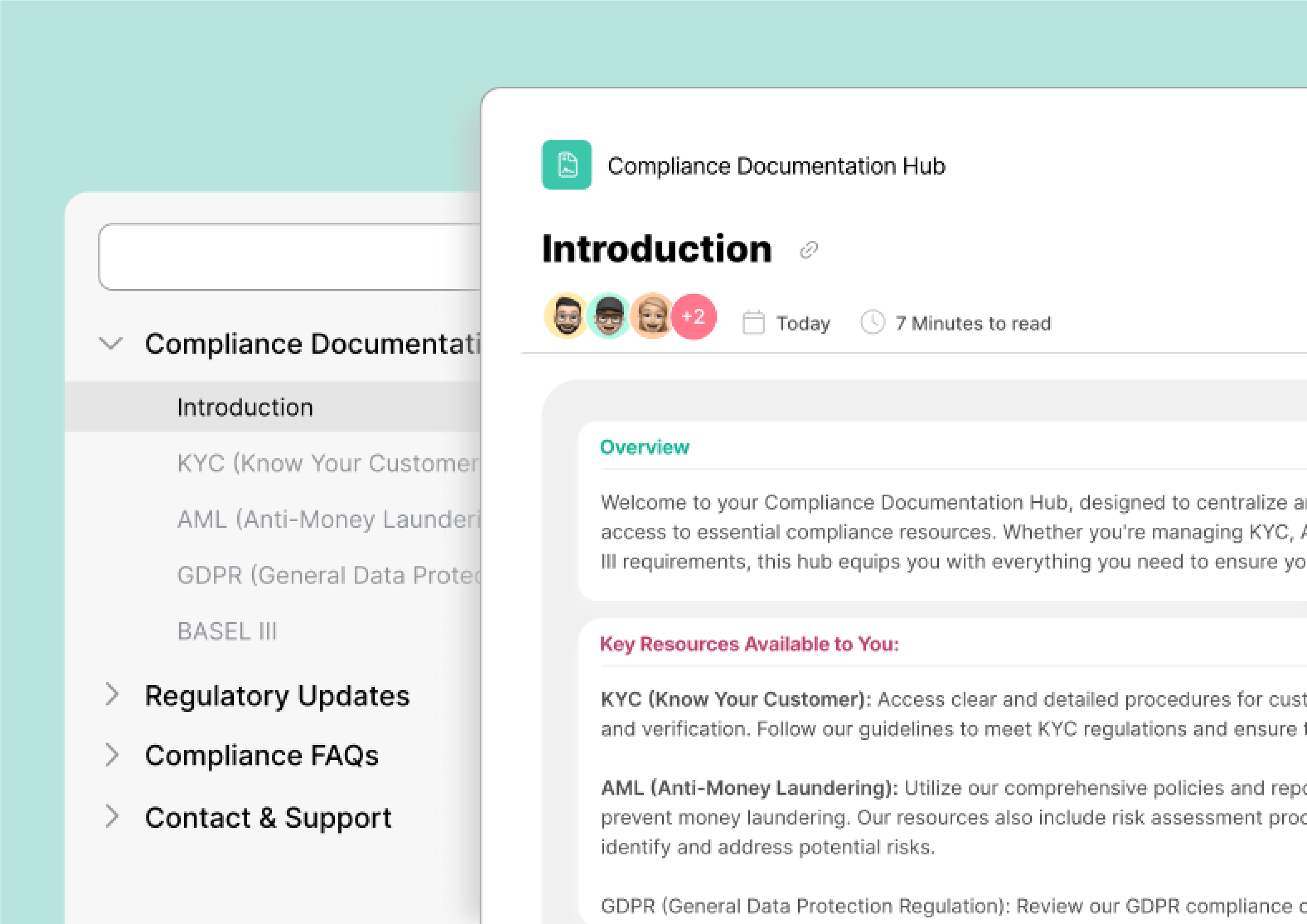

Banks maintain regulatory compliance through simplifying their banking system operations according to current rules, which include AML (Anti-Money Laundering) protocols and KYC (Know Your Customer) obligations, together with data protection mandates (such as GDPR). Banks achieve better control of regulatory compliance when they apply automation to their compliance tasks since this eliminates human errors and provides both accurate reports and prompt regulatory updates.

The organization of information in a proper method produces smoother audit procedures. Automated record-keeping and transaction monitoring systems enabled by centralized record-keeping enable banks to exhibit regulatory compliance more efficiently, thus avoiding major financial and reputation penalties.

Empower your team with the right knowledge at the right time using Document360.

GET STARTED

Key Strategies for Streamlining Banking Operations

Use digital tools to optimize processes

To advance operations, banks should apply digital tools that improve both complexity and workflow functionality.

In the same spirit of digital transformation, Document360 has helped financial services providers optimize their internal support operations. Helcim moved from a basic help site to a full-fledged learning hub for customers. With features like block editor, analytics, and article management tools, Helcim now offers a self-serve experience that enhances transparency and supports customer success.

Callum Yates, Manager of Customer Support & Success at Helcim, shared:

“The ability to customize and brand the knowledge base as a Learning Center has helped us deliver a more cohesive and professional experience for our customers.”

Through mobile banking applications, people can perform their bank account maintenance, fund transfers, and bill payments from any location. The mobile banking sector produced revenues of $1.3 billion in the recent year, and analysts project this number will triple by 2030 due to consumer choice for digital banking methods. Customers benefit from two core features in these apps, which provide secure transactions through biometric authentication and efficient real-time payment functionalities.

Transactions for customers become more secure and transparent due to blockchain technology and customers can make cash deposits using Cash Deposit Machines (CDMs). Through voice-activated banking, users can conduct tasks such as balance checks and payments through verbal requests and open banking APIs provide combined access to various banking services from one application.

Data analytics tools provide personalized services like tailored loan offers, improving customer satisfaction.

Cloud-based systems help financial institutions reduce operating expenses while speeding up their operational processes, thus banks achieve service deployment 40% faster with 15% lower IT costs. Through workflow integration, banks help their employees reduce expenses while speeding up processes, while simultaneously providing improved services to customers

Good to note: When implementing these tools, it’s important to assess the specific needs of your operations. Not all teams may be familiar with them, so clear communication and training are essential.

Automate onboarding for speed and accuracy

Bank automation of key processes, especially during onboarding, ensures rapid service, precision, and a better experience for both customers and employees. Tasks like document verification, ID checks, and compliance can be automated to reduce errors and delays.

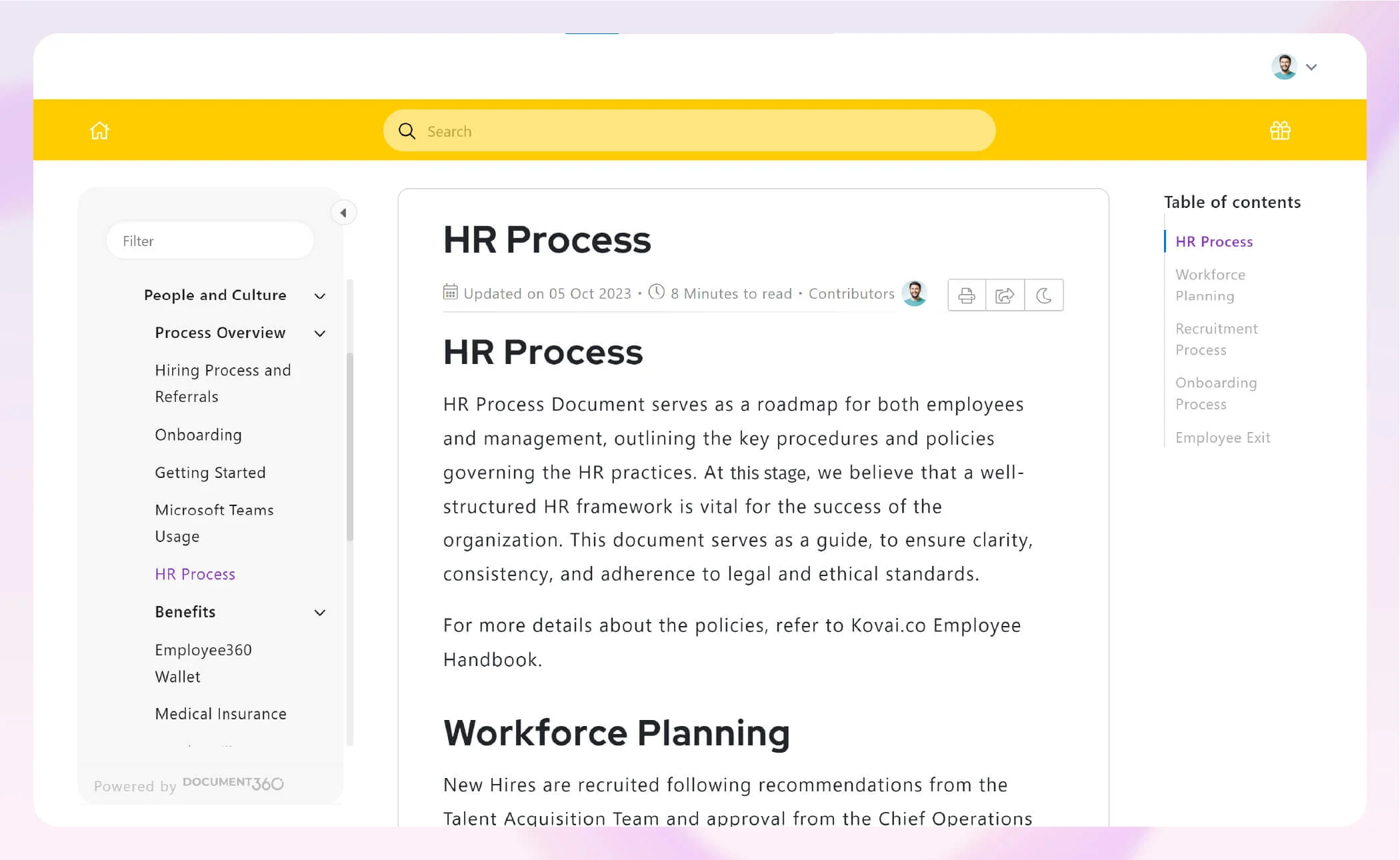

Document360 serves as a centralized knowledge hub for (Un)Common Logic, and onboarding has improved significantly once they moved from scattered systems. Version-controlled content, role-based access, and workflow automation now allow new hires to complete tasks efficiently while minimizing repetitive work.

On the customer side, View Inc’s Vice President says,

“Document360 has made it easier for us to onboard customers. We just need to send them the link to our online documentation site.”

It enables interactive knowledge bases for onboarding, guiding users through account setup and activation. Its AI-powered search, logical content structure, and customizable interface improve accessibility and understanding. APIs help integrate the knowledge base with existing systems, ensuring a consistent user experience.

Factors like compliance, customer experience, and the complexity of onboarding tasks should guide the level of automation needed.

Cut wait times with smart queue management

A smart queue management system helps banks decrease waiting times by optimizing their customer queues. Customers who visit a branch office use a kiosk/mobile application to check in before receiving either a digital queue identification or a physical ticket assignment. Real-time system updates display waiting durations to customers while they are waiting in the queue. Customers rushing to deposit money can use self-service kiosks, while loan applications need to be submitted to specialists.

The system sends notifications to personnel that show busy service areas to enable better resource distribution throughout peak operation times. Virtual queuing technology enables customers to join digital queues using mobile apps, which will alert them when it is their turn.

The system records information regarding customer waiting durations, service time, as well as patterns of customer movement throughout the banking spaces. Bank applications analyze this data to locate holding points while enhancing operational methods plus workforce distribution.

If analysis reveals extended wait times on Mondays, the organization schedules additional staff to meet customer needs. The automated customer flow management in QMS creates shorter waiting periods, which improves operational efficiency and delivers superior banking services to customers.

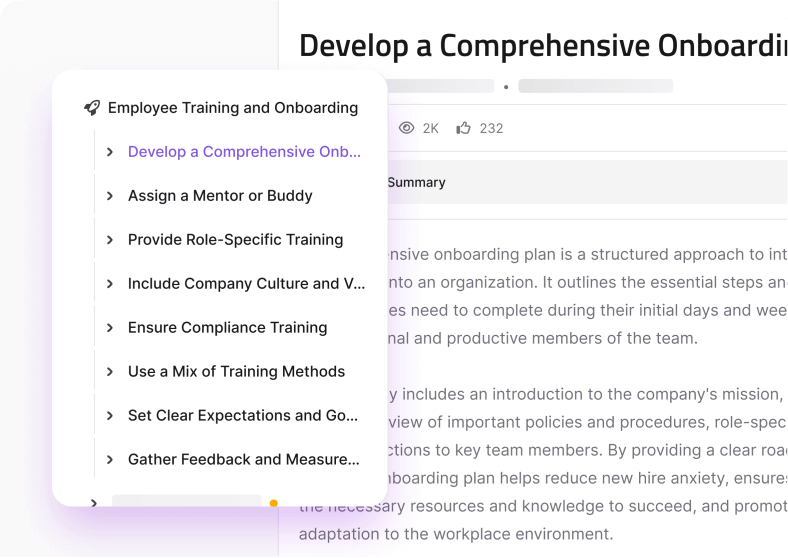

Train employees for better efficiency

Banks must provide detailed instructions about job duties, organizational processes, and specific responsibilities for new hires to succeed. Inadequate training leads to confusion and inefficiencies, causing delays and more errors.

With an internal knowledge base, banks can centralize training content—from employee handbooks and tool manuals to step-by-step task guides. Its AI-powered search and version control ensure staff always access the latest information quickly and accurately.

Standardize workflows and remove redundancies

The key element for operational efficiency in banking involves standardizing workflows and removing duplicate functions. Manual paperwork processes and filing methods are obsolete and inefficient procedures in the 21st century. Standardized workflows developed by banks help get rid of repetitive operations to maintain consistency across organizational departments

A typical loan processing workflow includes a credit analyst, compliance teams, alongside customer support personnel. Automation handles several tasks for the above workflow: document verification, credit checks and approval process management, which reduces errors and accelerates operations. The system enables smooth processing of loan applications through each step by avoiding time-wasting and redundant communication.

Sophi team emphasizes how Document360 serves as a single location for product resource guidelines so employees can immediately find their necessary documentation. The workflow now experiences fewer redundancies since employees no longer need to question each other and document updates and publication tasks proceed swiftly. Banks can protect sensitive information through mixed access features because it separate public from private data so that all necessary resources remain accessible.

A defined standard workflow helps employees to maintain unified processes, which cuts down team communication issues while fostering better cooperation among departments

Improve communication and collaboration

“Collaboration is the key part of the success of any organization, executed through a clearly defined vision and mission and based on transparency and constant communication.”

Banks need strong communication and teamwork to process loans, detect fraud and onboard new customers. Constant collaboration occurs between departmental teams such as customer service, risk management and compliance operations. Processes that have clear paths enable teams to share identical current information, which minimizes errors in addition to eliminating delays.

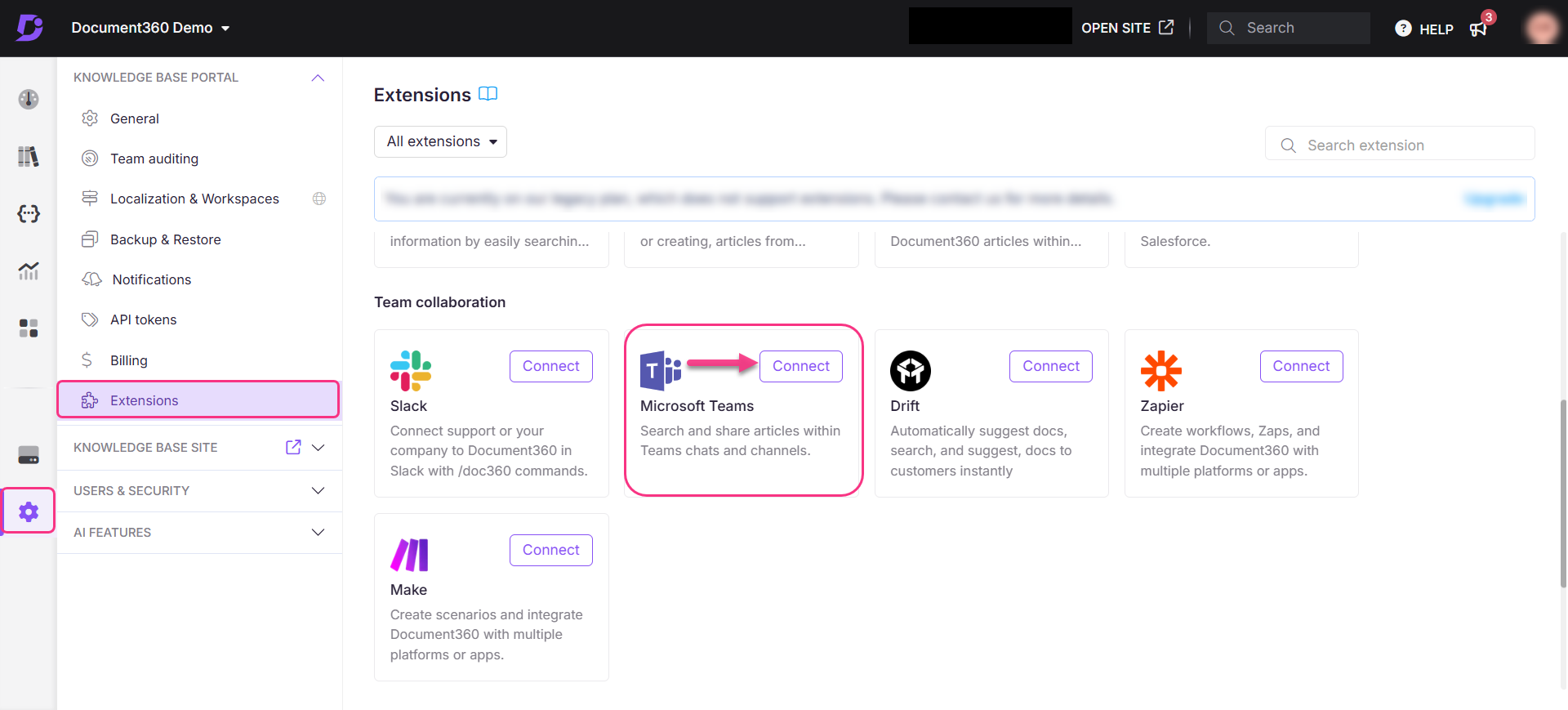

Document360 functions as a single repository to enhance communication through its centralized knowledge platform. The unified location allows team members to view policies and procedures with training materials alongside each other. The tool provides users with easy information sharing capabilities through its Microsoft Teams and Slack integrations, which eliminates the need to move between different platforms

Conclusion

Streamlining banking operations is no longer optional—it’s essential for staying competitive. While banks have traditionally relied on manual processes, the rise of fintechs and digital-only banks has raised customer expectations for speed, convenience, and personalized service. By cutting wait times, reducing errors, and improving efficiency, banks can deliver a superior customer experience that builds trust and loyalty. Bank operations that minimize waiting periods while decreasing mistakes and increasing performance capability create customers who both believe in and maintain their loyalty towards banking institutions.

However, the journey to streamlining isn’t without challenges, from outdated systems and regulatory hurdles to employee resistance and high costs. Yet, the rewards—lower operational costs, faster service delivery, and a stronger competitive edge—far outweigh the obstacles.

In the end, streamlining operations is a commitment to delivering excellence. Banks that invest in streamlining will retain customers, build a reputation for reliability and innovation in an increasingly competitive market.

Frequently Asked Questions

1. What are the key benefits of streamlining banking operations?

Banking efficiency, cost reduction, and creating better customer satisfaction, while also minimizing operational expenses. Streamlining back operations maintains competition through streamlining by enhancing their delivery speed and resource management capabilities.

2. How does streamlining operations impact customer experience?

Operation streamlining produces better customer experiences because it minimizes wait times while also delivering more swift, dependable service delivery.

For instance, automated systems like AI-powered chatbots resolve customer queries instantly, while mobile banking apps allow customers to manage accounts anytime, anywhere.

The analysis of streamlined data enables organizations to create personalized services that provide individualized loan options as well as spending feedback. Such technology refinements result in more satisfied customers who demonstrate extended loyalty to the business.

3. What challenges do banks face in streamlining operations?

Banks face several challenges in streamlining operations, including:

- Outdated systems act as barriers when attempting to integrate old technology with current tools.

- Banks must guarantee that any new processes at every level meet all required regulations.

- Staff members tend to resist changes because they lack proper training or because they fear getting replaced from their current positions.

- New technologies, together with related systems, demand substantial financial resources. Global spending on digital transformation in banking is expected to reach $1.3 trillion by 2025.

- Customer data protection is another issue when implementing digital tools. The global banking industry faces average cybersecurity breaches that result in $18.3 million in expenses each time one occurs in 2023.

4. What is the future of banking operations?

New banking operations will depend on digital transformation and automation to create their future systems. Technologies like AI, blockchain, and cloud computing will play a key role in making processes faster, more secure, and cost-effective. For example, AI will enable real-time fraud detection, while blockchain will enhance transaction transparency.

Banks are focusing on developing personalized services through omnichannel to let users connect conveniently between various platforms. Sustainable banking practices and ethical operations will steer the development of the industry toward its new course.

–

–