Fintech is a highly regulated industry with lots of competition. You’re competing against some centuries-old institutions and young startups with millions of dollars in venture capital backing them. There are all sorts of technologies you can take advantage of in fintech, including digital banking, open banking, blockchain, and ML/AI.

As a result of this complexity, companies are considering a fintech knowledge base to help them with their operations. A knowledge base is a centralized repository of information that customers or employees can consult whenever they have a question about the business. It’s a website with information architecture that offers articles relating to every aspect of the company. It may or may not utilize AI as part of its infrastructure.

Your knowledge base may be customer-facing, meaning that it’s a self-service support knowledge base that customers use to solve their queries. On the other hand, your knowledge base may be employee-focused. This means that your knowledge base is internal, and employees use it to get better at their jobs. For a fintech company, both are vital.

How Knowledge Bases Enhance Fintech Operations

Knowledge bases enhance fintech operations by making information much easier to find. Instead of building knowledge piecemeal, where individuals have to hunt for it, the knowledge base brings it all together. When knowledge is all in one place, this increases efficiency and productivity for the organization.

Customers will be much happier with your fintech organization when you make information available instead of hiding it away. Customer satisfaction will rise as customers can search for the content they want and find information about your products. They also find quick answers to their queries, making them happier overall with your business. Customer retention is positively impacted when customers have a knowledge base.

Surfacing knowledge makes your FinTech organization more efficient and productive overall. When employees and customers can find fintech records and discover all sorts of technical information about your fintech products, your organization will experience significant growth. Freeing up information from the organization in the form of a knowledge base will positively impact your fintech business, so you need to purposely document.

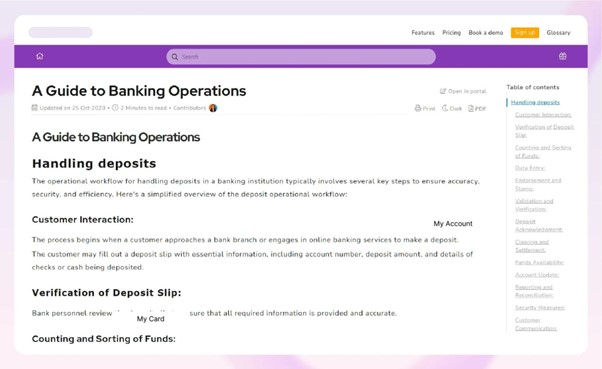

Knowledge Base Example

Advantages of a Knowledge Base in the Fintech Industry

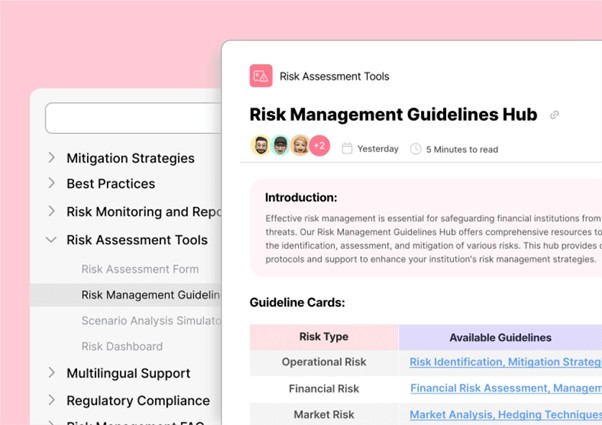

Centralized Source of Financial Information

A knowledge base in fintech is a centralized source of financial information, meaning that users can search the knowledge base whenever they have a question. Knowing all in one place is a much more productive way to approach information architecture and users will be much happier with a quick search. Customers can consult the knowledge base without having to speak to an agent, which speeds up the productivity of your financial organization. This also works on the employee side since whenever they have a question, they can search the knowledge base to find an answer.

Quick access and retrieval of policies

Agents can quickly access and retrieve policies meaning that when they are working in the organization they can easily find out how the business operates. Instead of confusing or hunting around for the right policy, agents can search for policies in the knowledge base and ensure that their knowledge remains up-to-date. Fintech companies have lots of policies so we must make it easy for agents to retrieve them. A knowledge base is an answer.

Supporting Continuous Learning and Auditing

Centralizing knowledge supports continuous learning and auditing so that staff members can continually improve their knowledge about the business. A robust knowledge base means that staff can quickly consult it if they have a question and learning within the organization remains high. If the staff are audited, they should have access to instant forms of knowledge in the company, making it more likely that they will pass the audit.

Compliance with Data Regulations (GDPR, KYC)

Some data regulations say that organizations need to comply with various rules and that’s why having a comprehensive knowledge base will help with compliance. All staff members can consult the knowledge base about GDPR or KYC (a process that financial institutions use to verify the identity of their customers) so that no one misses out on important regulations for users because they didn’t have the training. It is highly illegal for staff members not to comply with regulations, so having the rules in your knowledge base is important.

Training and Development

A knowledge base helps with ongoing training and development by keeping important information in one place. A knowledge base is a vital repository of information that is essential for every staff member. Staff can learn at their own pace as the knowledge base provides them with knowledge for their training. A knowledge base preserves knowledge for future training programs.

Mitigating Risks of Data Breaches

By keeping your data in a knowledge base you mitigate the risk of data breaches because you are storing it somewhere secure. Not just anyone has access to the knowledge base, just select staff members, so you can secure the knowledge base against potential threats. It’s always more secure to store your knowledge in a knowledge base and ensure that your reputation for security remains intact.

Interested in Document360 AI-Powered Knowledge Base? Schedule a demo with one of our experts

Book A Demo

Challenges in Fintech Knowledge Base Implementation

Keeping Information Up-to-Date in a Fast-Paced Industry

Keeping your knowledge base up-to-date can be challenging as the industry changes so quickly. Out-of-date knowledge bases threaten the trust of your users and decrease the chances that anyone will use them. The knowledge in your knowledge base must accurately reflect the state of your business in fintech, or users will abandon it. Regularly auditing and updating your knowledge base is key to success.

Managing Information Duplication and Access Control

It’s easy for users to duplicate content, but you must manage this for your knowledge base to operate smoothly. Similarly, managing access control means controlling the users who have access to your knowledge. If someone leaves the team or the company, they must have their access revoked. If your knowledge base is public, make sure customers can easily find it to discover information.

Adapting to New Technology and Processes

You might use new technologies and processes when implementing your knowledge base. This means your team has to adapt or risk falling behind. Train everyone in the new technology, especially if you’re using a more advanced knowledge base software, and make them aware of new processes – especially ones that affect the knowledge base. Switching to an AI-powered knowledge base is no excuse for your employees to abandon the tech.

Also Read: Importance of Having A Credit Union Knowledge Base

Tips to Choose a Knowledge Base for Your Fintech

AI-Assistive Knowledge Management

You must implement an AI-powered knowledge base solution like Document360 that integrates AI into the software. This means that the knowledge base has an AI assistant that helps you write content and add extra features like metadata and FAQs. Most businesses will thrive when they have an AI-assistive knowledge base to help them create content, as this will be superior to a non-AI knowledge base.

AI also works on the user side to improve search with natural language processing. AI-powered search significantly improves the search process by making it easier to find content and respond to even vague user queries. AI in search yields the correct results much faster than search without AI and increases customer satisfaction.

Robust Security features

Robust security features are essential when it comes to safeguarding your knowledge. You must be able to control who accesses your content down to a page level. Choose a knowledge base that uses authentication to let users onto the knowledge base. Two-factor authentication is ideal, as users will require two devices to log into your knowledge base. Also, ensure you have strong security against unwanted threats and attacks.

Business Glossary

Your knowledge base should have a business glossary that centralizes all of the unique terms your business uses in a list. It should be easy to add business terms to the glossary, and ideally, AI would intervene to add terms to it. AI can provide a comprehensive collection of terms used throughout your organization, providing clear definitions and explanations for ambiguous terms.

Granular access control capabilities

We should ensure that we have control over who can access the content down to a granular level. This means being able to centrally control which pages a user can access on the knowledge base and remove them entirely if desired. It’s important to be able to manage the knowledge base’s access and hide certain pages or give someone full access. There should be at least one central administrator who can manage this task.

GDPR and SOC II Compliance

GDPR is a data protection regulation, and SOC 2 is a cybersecurity framework. You should make sure your knowledge base is compliant with both these frameworks so that you can stay within the law. Businesses can face hefty fines if they fail to comply with GDPR, so it’s best to follow best practices. Choose software that is GDPR and SOC 2 compliant to make things easy.

Document360 is GDPR and SOCII Certified, demonstrating a data privacy and security commitment.

Wrapping Up

A fintech knowledge base is crucial for knowledge sharing and ongoing training and development. It might be possible to get along without one, but once you adopt one, there will be no looking back. As long as you adhere to cybersecurity best practices and keep your knowledge base up-to-date, there is no downside to having one.

Both customers and employees can benefit from a fintech knowledge base, and you can set your knowledge base up to appeal to either party. Making your knowledge base public or private is easy enough with the right knowledge base software. Controlling access down to a page level is also part of good software.

Fintech is fast-paced and complex, so documenting your knowledge in a knowledge base is sure to give you an edge. Crack the code of the industry by developing a powerful knowledge base driven by AI. Start creating a knowledge base for your fintech company today.

–

–