Credit unions play a crucial role in shaping individuals’ financial well-being, yet ensuring each member feels genuinely valued.

Whether visiting a branch or opting for digital banking, every interaction is an opportunity to build a meaningful connection. However, challenges like long wait times and impersonal systems can dampen this experience.

So, how do we find the right balance between the convenience of AI and digital systems and human empathy?

It’s not all about seamless transactions; it’s about prioritizing customer experience by providing high-quality service that takes care of their needs now and in the future.

In this article, we will look at the different ways to improve the credit union members’ experience.

Importance of member experience in credit unions

Member experience is indispensable in credit unions. Even the not-so-great experiences, while nobody likes them, can actually be super helpful. They give credit unions valuable insights to tweak things, keep members around, and build up their rep for awesome customer service.

But let’s focus on the good stuff— the importance of a great member experience.

First things first, happy members are more likely to renew memberships and engage with credit union offers.

There’s also no greater brand ambassador like a satisfied member. Nielsen’s statistics show that 92% of consumers trust recommendations from friends and relatives more than other forms of advertising, proving the significance of positive word-of-mouth referrals.

Moreover, the credit union’s success is determined by the member experience rather than the products or services offered, resulting in better financial performance.

According to recent statistics, only 20% of customers in the credit union industry feel engaged with the brand. Over 73% feel that credit unions do not care for their engagement with the brand and they are after financial well-being only. There is a huge gap in customer experience served at Credit Unions compared to

It was also established that 86% of members would pay more for a better customer experience, according to Forbes via LinkedIn survey results.

Also, positive member experience makes it less likely for members to defect to rival institutions. Loyal credit union members are also 5.6 times more likely to forgive a mistake made by the institution.

Top 9 strategies to improve Credit Union Member Experience

Struggling to give your members the best experience? We’ve put together nine strategies to improve credit unions to deliver an out-of-the-box customer experience:

1. Always put the member first

“Customers come first” is a phrase that’s been around for a while, but we don’t fully understand what it means. It’s deeper than just listening to a few feedbacks.

“Putting the member first” is about being front of the line and meeting every requirement and activity focused on members’ needs, customization, and health.

It involves having a close dialogue with the member, listening to their feedback, understanding what they want, and developing products and services that meet those needs.

Credit unions can achieve this by establishing internal policies and regulations that assure customers’ preferences, offering advice at community gatherings, and communicating openly and transparently.

2. Provide personalized financial education or counseling

Provide credit union members with customized guidance and assistance to make sound financial decisions, manage their money correctly, and reach their financial goals.

The National Foundation for Credit Counseling (NFCC) says that 67% of people who have had financial counseling are managing their finances better, and 65% of this number have higher credit scores within 18 months.

Let’s say a member nearing retirement consults a Certified Retirement Planning Specialist (CRPS) at the credit union’s Wealth Management Department. The specialist conducts a comprehensive analysis of the member’s retirement plans, financial resources, and income to design a strategy to maximize savings, optimize Social Security benefits, and minimize tax liabilities.

Financial education or counseling can be introduced to credit union members by restructuring the content, medium of delivery, and kind of assistance provided to each member based on their individual needs and preferences.

How to provide personalized financial education or counseling effectively:

- Assess each client’s financial position and level of finance knowledge to know what they want, the problems they have, and the things they don’t know or are inexperienced in.

- Give financial education and consultation in different forms tailored to different personal learning styles and preferences.

- Make it possible for them to choose the format that will be most comfortable for them.

- Meet with your team members routinely (twice or thrice a week) to check on their progress, answer their queries, and give them supportive advice. This increases accountability, and the members have more reasons to meet the financial targets set.

- Open the door to a wide range of financial counseling and information resources that members can use as the basis for their knowledge and decision-making. These resources can include calculators, budgeting templates, articles, videos, and online learning materials.

- Assist your members in taking charge of their personal finances and making their financial calculations sensibly.

Also read: 5 Key Steps for Seamless New Client Onboarding in Wealth Management

3. Drive loyalty and deepen relationships

Credit unions can use strategies like active communication, personalized offers, and community involvement to improve member satisfaction and loyalty.

According to Statista, the global customer loyalty management market is anticipated to grow from over 5.5 billion U.S. dollars to 24 billion by 2028.

Paying particular attention to loyalty and cultivating these relationships can bring numerous benefits, such as enhanced retention rate, satisfaction, referrals, cross-selling enablement, and cost savings, which would increase member lifetime value in the long run.

4. Adopt a knowledge base solution

Have you ever wondered why credit unions struggle with document access, customer service disruption, and sloppy information? Well, we know why.

Short answer, they don’t have a centralized knowledge management system.

Having a centralized knowledge base offers ease of access to data, conserves resources, and guarantees comprehensiveness that results in high-quality service.

Note: Credit unions require a knowledge base that serves two purposes: One for the internal use of employees and the other for external use for members.

Also, when picking your next knowledge-based software solution, remember that the tech component is just one piece of the puzzle. Combine your knowledge base efforts with a centralized content strategy; credit unions can efficiently create, update, manage, and share content organized and systematically.

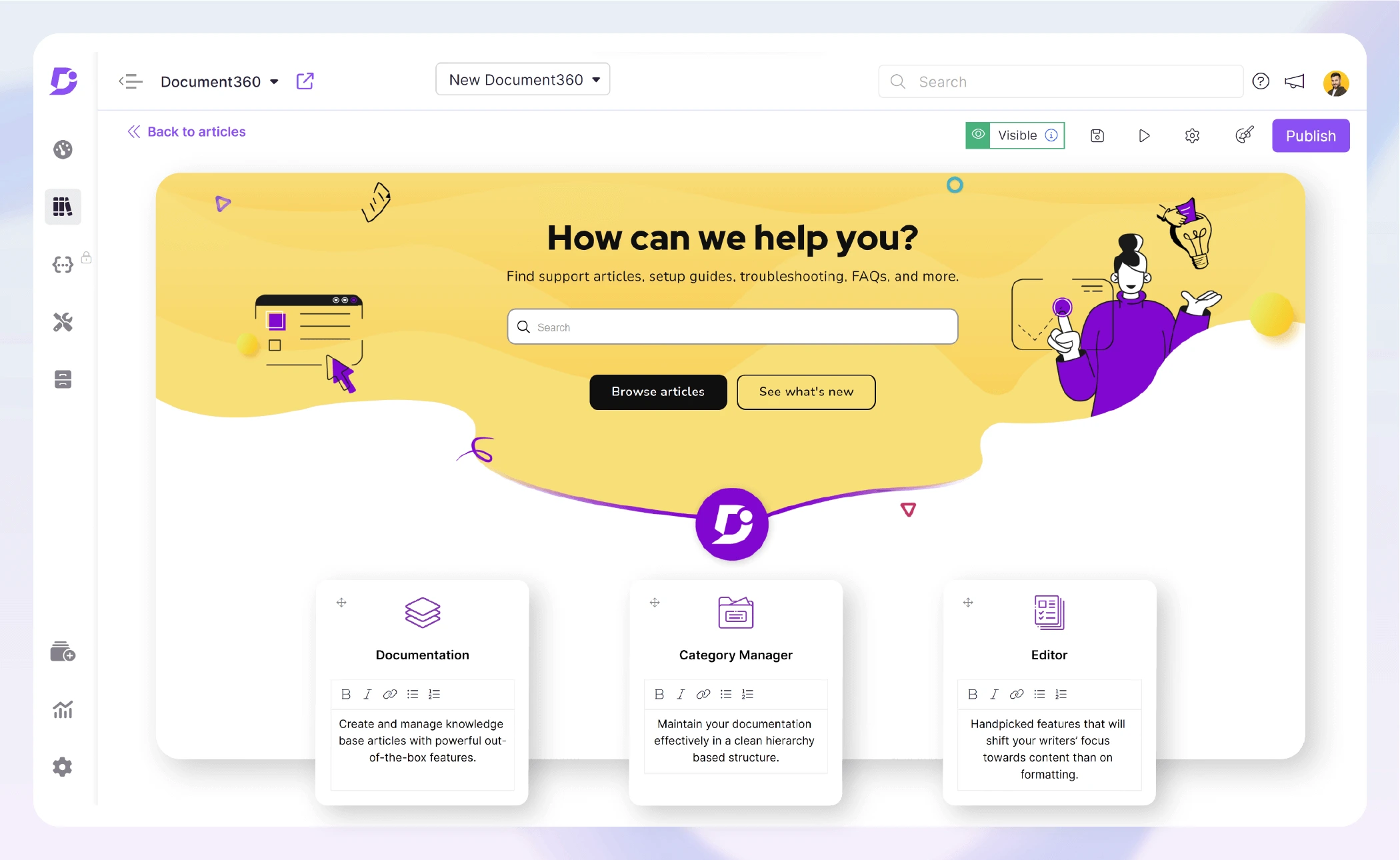

Schedule a demo with one of our experts to take a deeper dive into Document360

Book A Demo

Check out our video on Knowledge Base for Financial Institution

Let’s look at why it’s so important for credit unions to have a centralized knowledge base system:

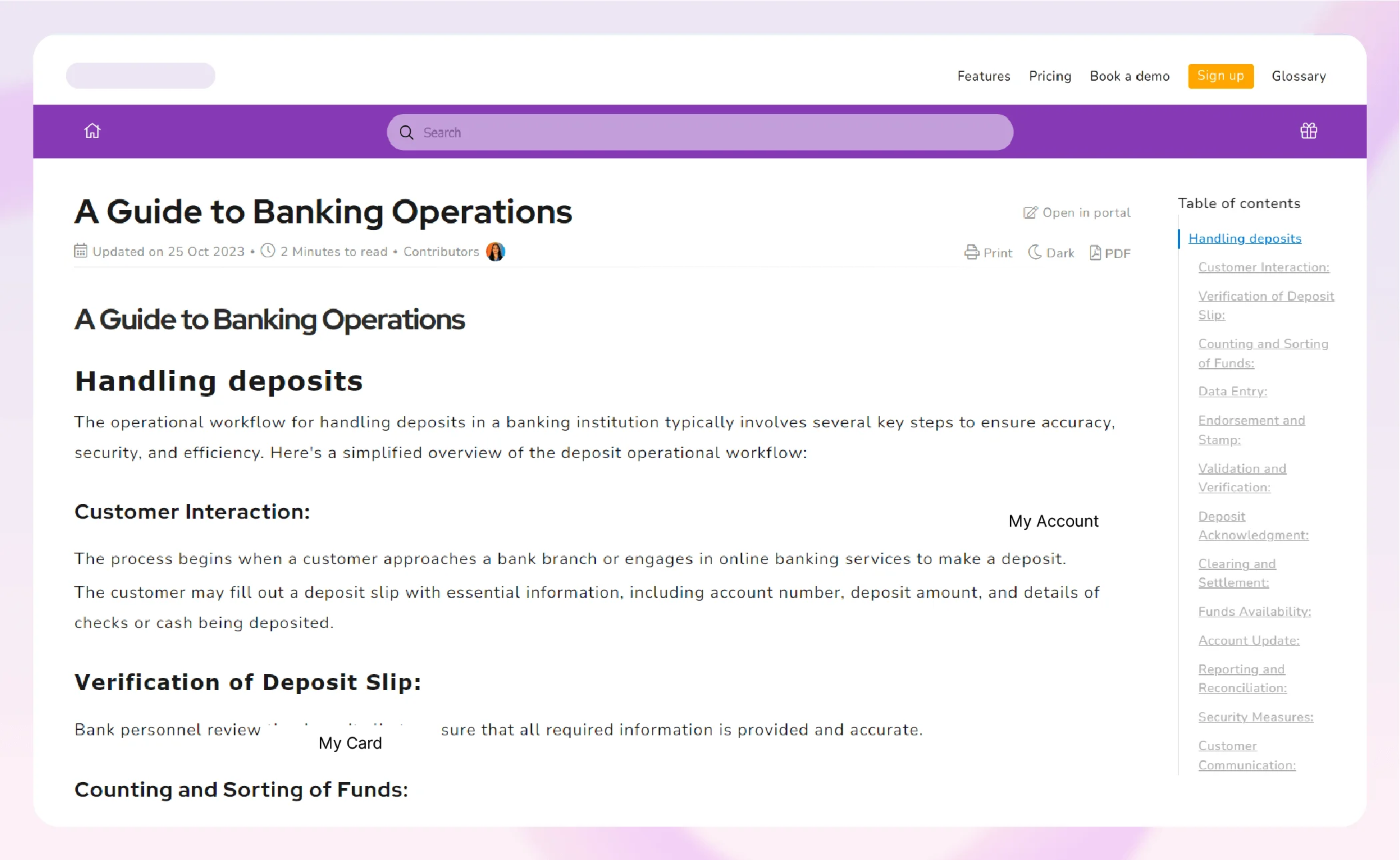

Helps to onboard and train employees quickly.

Implementing a knowledge base system will make it easier to onboard your employees and get them up to speed.

In this case, the knowledge base acts as a virtual library where the employees can obtain the desired information, such as member onboarding rules, account opening protocols, and customer service standards.

Managers in credit unions have to work harder than usual because they often find themselves juggling a never-ending stream of questions, fixing issues, and handling unplanned problems. They have to navigate between new employees who aren’t yet self-sufficient and nervous staff members who doubt their ability to handle tasks independently.

This is where a knowledge base system comes in. Developing a knowledge base system and tailored performance training for credit union employees reduces questions, errors, and onboarding time.

Example of banking operating guide created using Document360

A Forbes research showed that employees’ confidence at work correlates with improved job performance and customer service, ultimately boosting business results and member loyalty.

While we advocate for building systems to make onboarding employees easier, it’s important that we don’t forget to invest in people.

Below are some of the ways you can invest in your employees to make their onboarding smoother and build their confidence:

- Provide Clear Expectations

- Offer Training and Development

- Give Constructive Feedback

- Encourage Risk-Taking

- Recognize Achievements

- Provide Mentorship and Support

- Foster a Positive Work Environment

- Lead by Example

- Offer Opportunities for Growth

- Celebrate Progress

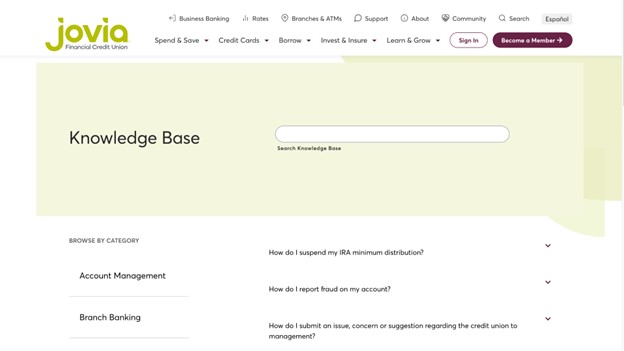

Improves financial literacy with educational resources in one place

With a knowledge base system, all the educational resources that could help members are neatly packed into one central, easy-to-access platform.

With this platform in place, it’ll be easier for members to access educational tools, allowing them to explore various financial topics and gain confidence in managing their finances independently.

Jovia Financial Credit Union’s knowledge base is a perfect example. They have all the resources a member needs in different categories, including loans, mortgages, account management, etc.

Source: Jovia’s Financial Credit Union

Reduces confusion

Knowledge base solution removes data fragmentation through a centralized collection of vital information for staff and members. Because of the centralized documentation, the credit union communications are smooth and without noticeable errors.

It also reduces data and information silos which helps to avoid repetitive tasks and data inconsistencies.

Good to know: Data silo happens when information is held by one department and it’s not fully accessible by the other departments in an organization

Reduces support tickets and support costs.

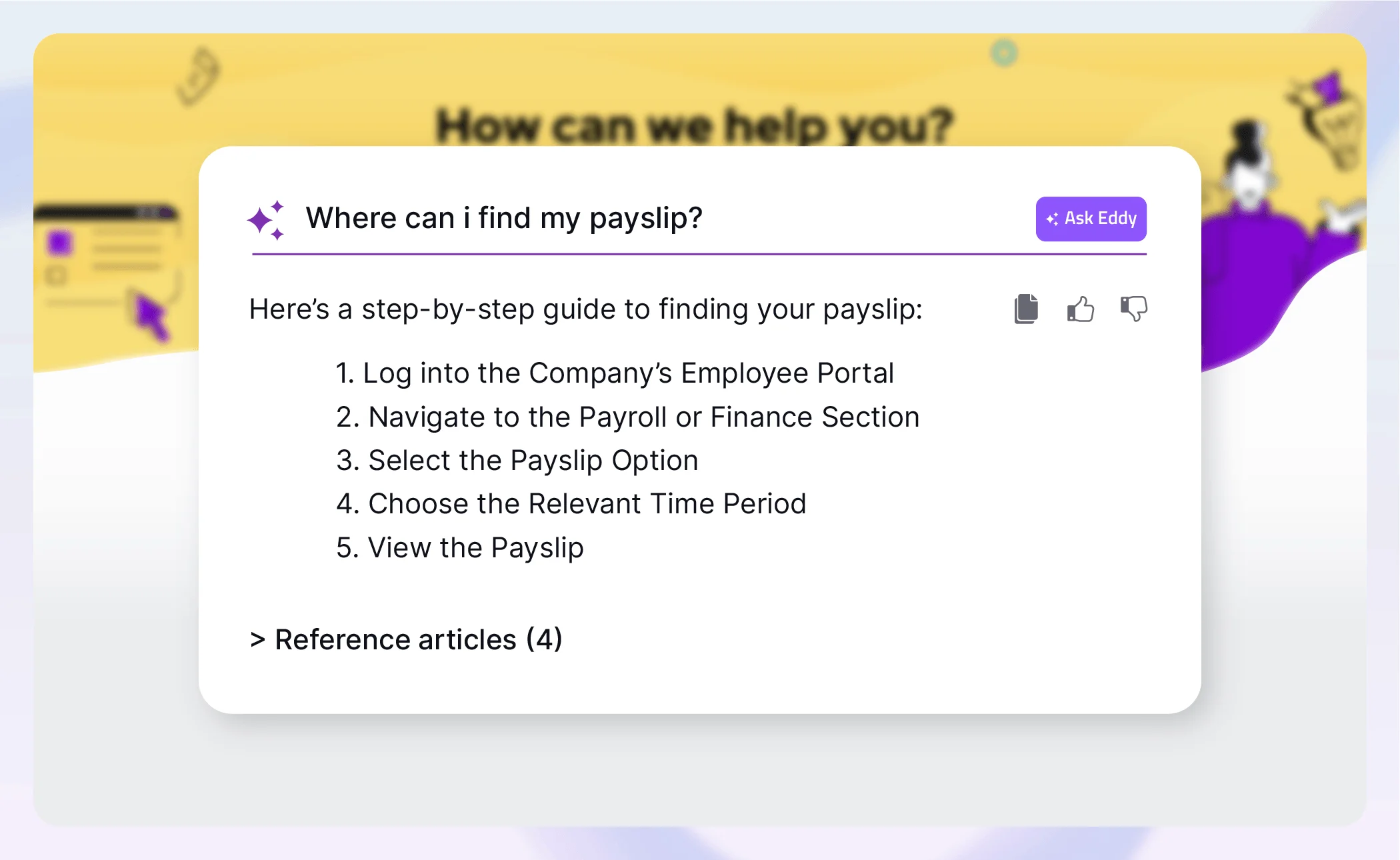

A self-service knowledge base allows users to resolve their issues on their own, reducing the volume of tickets, saving support costs, and shortening the overall resolution times.

For example, when a member encounters a banking error, they can immediately search the knowledge base for solutions.

Unlike with CS teams that can get burnt out with increasing queries, a knowledge base can accommodate increasing queries without any additional cost.

Provides a personalized experience for the credit union with inbuilt AI

AI-powered chatbots provide instant answers to FAQs, reducing response times and simplifying complex financial processes like loan applications. They also offer step-by-step guidance, ensuring a seamless experience.

Adopting an AI-powered knowledge base solution helps tailor interactions to individual needs. It analyzes member data for customized recommendations and assistance. There is no more guesswork or confusion—just a seamless personalized experience from start to finish.

“Why does personalization matter in knowledge bases?” You might ask.

Well, according to Segment’s state of personalization report, 56% of consumers will become repeat buyers when their experiences are personalized. On top of that, Gen Z’s will give up after one interaction where they don’t feel cared about. And now, who wouldn’t wish to feel special?

5. Optimize Omnichannel Experience

Most customers prefer mobile banking to a traditional bank branch. Now imagine a situation where online customers receive a different experience from customers over the counter. Crazy, right?

Whether at a branch or logging on to the Internet, you should still be served the same way. Anything less is frustrating.

An omnichannel experience for credit union members is all about providing easy and flawless banking through branches, online and mobile.

Consistency, integration, personalization, and customization are the formulas for smoothness and reliability. Omnichannel enhances member satisfaction and boosts operational efficiencies and cost-effectiveness.

Good to note: To avoid spreading resources thin and diluting effectiveness, focus on two or three critical cross-channel member journeys. This approach allows credit unions to prioritize efforts effectively, deliver tailored messages and offerings that resonate with target groups, and ensure a seamless user experience.

6. Focus on Accelerating Digital Adoption

Digital adoption is no longer news or a trend in credit unions; it is a must-have!

What separates successful credit unions from others is their innovation around these digital technologies and how they use them to better serve their members.

Credit unions can keep members’ information safe with features such as multi-factor authentication and password managers. Also, regular software updates and cyber security training for all employees add an extra layer of protection.

Members’ adoption of self-service capabilities results in higher member satisfaction.

How?

There are several psychological and practical drivers behind this. One psychological driver is the embarrassment of interaction with agents or discussing financial difficulties. If the interaction is automated or virtual through chat, many members are more likely to feel more comfortable.

Other aspects of credit union digital adoption can accelerate, includes:

- User-Friendly Interfaces

- Mobile Banking

- Digital Payments

- Personalized Services–using data analytics and artificial intelligence

- Enhanced Security Measures

- Digital Member Onboarding

- Omnichannel Integration

When prioritized and implemented effectively, these aspects can accelerate credit union digital adoption and drive member engagement, satisfaction, and loyalty.

7. Measure key metrics

Credit unions that don’t track satisfaction, engagement, and retention are flying blind and cannot improve member experiences.

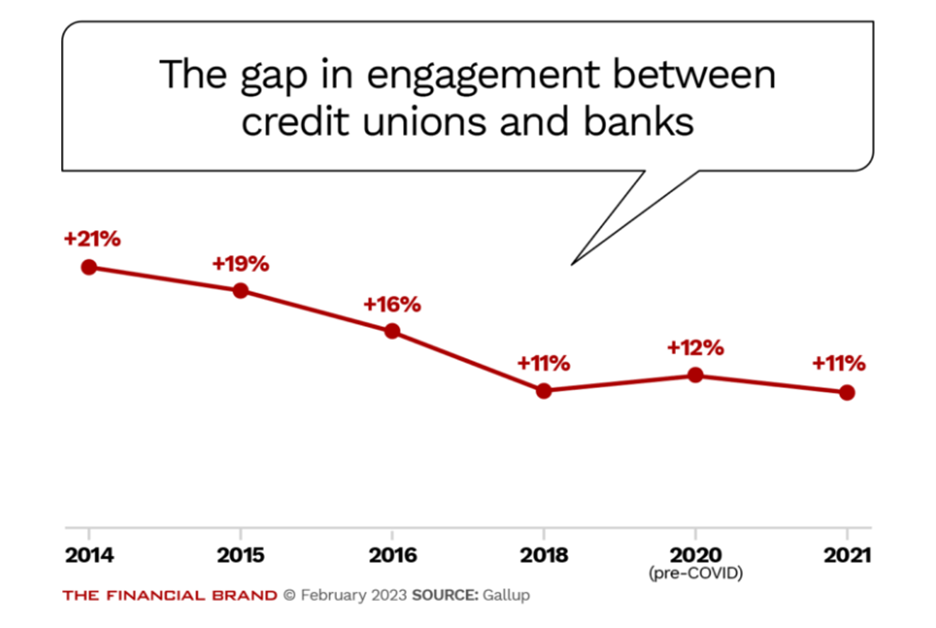

A study Gallup on customer engagement in Credit unions over bank shows that in 2014, credit unions had a +21% engagement premium and a +29% premium in their net promoter score, or NPS. By 2021, credit unions’ engagement premium had almost halved, to +11%, and the NPS premium had shrunk to just +17%.

Image source: The Financial Brand

Measuring key metrics like member satisfaction, engagement, and retention is more than just crunching numbers—it’s about getting the data to enhance members’ experience.

Credit unions can up their game by understanding what satisfies their members and using that data to customize their product offerings, services, and support accordingly.

With the data obtained from their members, credit unions can address the possible causes of customer churn, such as dissatisfaction with the service offered or lack of relevant products.

8. Investing in employee training and development

Employee training and development are pivotal to creating positive experiences for members.

You know what they say, “An angry employee makes an angry customer.”

Employees need to be well-trained to make sure they are putting their best foot forward when addressing members.

However, balancing training with day-to-day activities takes great effort and mindset – one of the biggest challenges in employee training.

So, how can credit unions overcome these obstacles to gain the best learning and development opportunities for the staff

- The training programs should be in harmony with organizational goals and members’ needs.

- Advocate for lifelong learning among the personnel to create a culture of continuous learning.

- Evaluate the training based on feedback surveys and performance indicators.

- Lastly, knowledge retention and application should be done through practical exercises and on-the-job training.

9. Adaptation to changing member needs

Credit union members all want one thing – ease. It is easier to run their financial transactions without any friction or security issues. It is easier to go into a physical branch without waiting in front of a long queue and having to go through a gazillion steps to see the customer representative.

But let’s not forget that members are also evolving. Yes, they want ease. They also expect transparent policies, robust security measures, and personalized experiences.

So, how do credit unions keep up with their members’ demands (it changes every now and then)? By evolving.

Credit unions need to evolve alongside their members. People want different things, technology keeps improving, and the market constantly changes. Also, economic ups and downs and new rules can affect members’ demands.

Yes, we know branches are pretty important, but who likes to do their banking in a physical one nowadays? Almost no one.

For credit unions to meet their members’ needs, they need to become more advanced in technology and leadership. Invest in the newest technologies, hire high-caliber professionals, and seek out collaboration.

Steve Round, co-founder at SaaScada in a fintech magazine, said,” Credit unions are adapting to finance industry changes by partnering with fintech, improving tech infrastructure, and providing personalized experiences. Unlike big banks closing branches, credit unions maintain physical locations while enhancing digital services for a tech-savvy clientele”.

So, mobile services, AI, and analytics are the doors to open new member opportunities and improve member experience.

Wrapping up

There, you have it– exactly how to improve credit union member experiences.

Credit unions can meet the evolving needs of their members while staying true to their community values. Focus on personalized service, leverage technology, invest in employee training, and don’t forget AI-powered knowledge base platforms.

If you’re looking for one of the best knowledge base platforms that can work both on the internal (employee) and external (members) side, Document360 is here for you.

Document 360 is an AI-powered knowledge base platform that allows you to build, share, and manage a knowledge base for members and teams. Book a demo today to see how we can help improve employee training and onboarding, and also reduce the number of support tickets you get from members.

–

–