Unstructured documents cause insurance agents to operate inefficiently because they waste time searching for documents which will lead to inaccurate late service and dissatisfied clients.

That’s not all!

When a vital employee leaves the company, the loss of skill can cause many setbacks to daily business operations, not to mention the money that would go into recruiting and training from scratch.

All these listed are big organizational issues, but they can be solved with a good knowledge base solution.

Insurance companies that operate with centralized knowledge platforms for information establish better decision capabilities, get better operational performance, and deliver heightened customer support, which leads to more revenue in the long run.

In this article, we’ll explore everything you need to know about insurance knowledge management (and the best solution on the market).

Let’s get started!

What Is Insurance Knowledge Management?

Insurance Knowledge Management is a single data hub that stores complete information about anything insurance-related: life, health, auto, commercial, and property insurance policies. The system provides accurate, current information to organizational staff starting from customer service representatives moving through adjusters and agents to underwriters and agents.

Jason Enneking, CTO of UGA Finance, notes, “As a small company with high turnover, Document360 helped us document procedures and policies, ensuring business continuity and progress even when employees depart.”

Insurers with ineffective knowledge management systems will experience operational inefficiencies together with regulatory noncompliance, which can lead to customer dissatisfaction.

Why Is Knowledge Management Important for the Insurance Industry?

A well-structured knowledge management creates essential functions for insurance organizations by enabling accurate work processes that follow industry regulations. The implementation of a robust knowledge management system provides multiple advantages, which include the following:

Quick Info Access Speeds Resolutions

An organization that gets correct information fast enables decision-makers to generate better outcomes more efficiently. Organizations in the insurance sector are leveraging knowledge management because 87% of them report financial advantages through generative AI use (91% in P&C and 82% in L&A).

A properly structured knowledge management system contains underwriting guidelines, claims policies, and risk assessments, which both shorten processing time and give employees real-time access to necessary information.

Arlington/Roe, a managing general agency and wholesale insurance broker, said that Document360 helps reduce the time spent solving issues and boosts the organization’s operational performance.

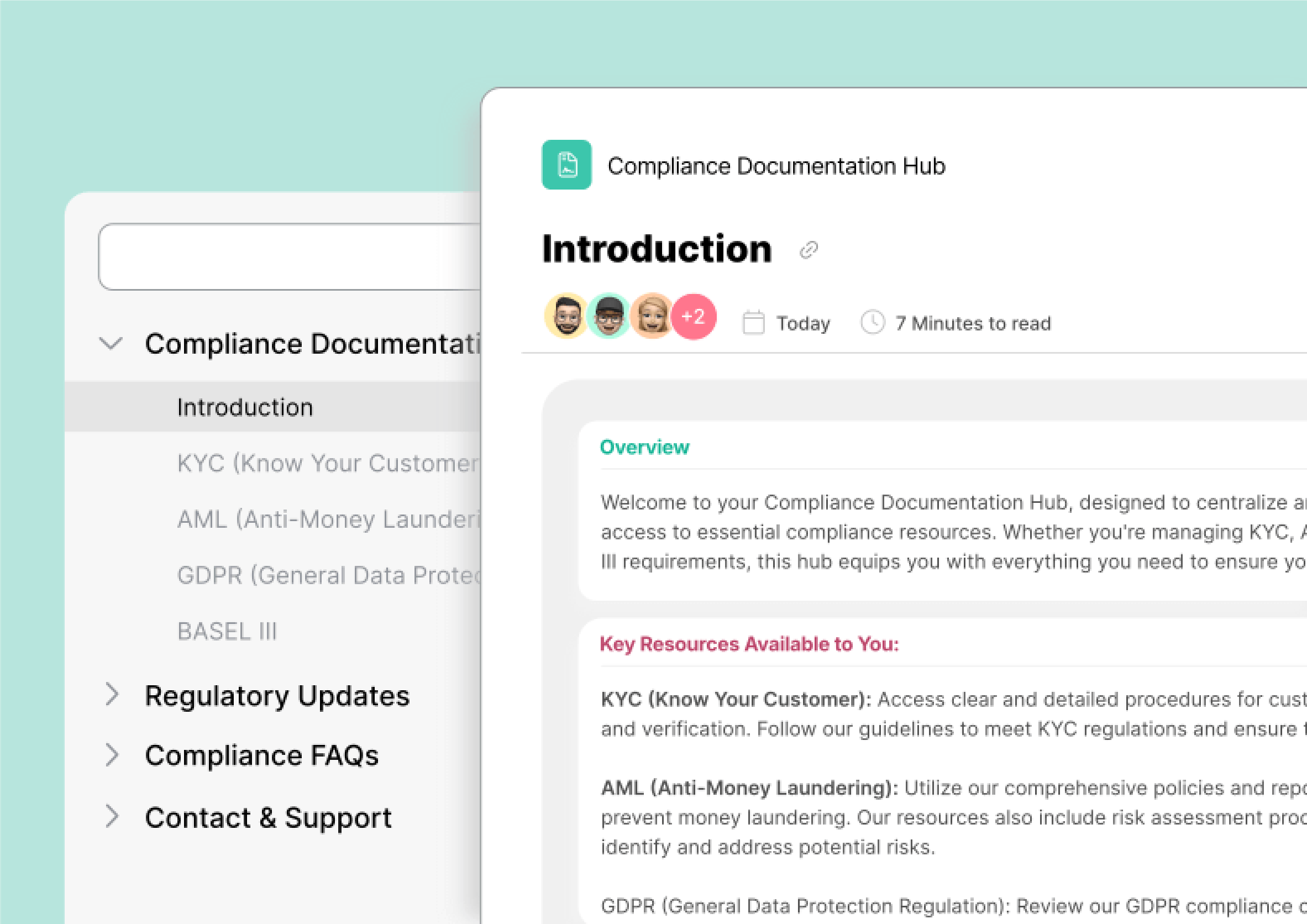

Ensures Regulatory Compliance

The implementation of KMS guarantees all employees receive updates about the latest regulatory policies and compliance practices, and industry best practices. A decentralized information system leads to non-compliance which produces financial penalties together with damage to reputation and potentially substantial legal consequences.

The National Association of Insurance Commissioners (USA) alongside the Financial Conduct Authority (UK) mandate insurance companies to operate with precise documentation while meeting new industry standard requirements. The knowledge base enables employees to access all compliance resources easily, thus reducing mistakes and ensuring correct procedural practices.

A well-documented knowledge management system is evidence for compliance adherence during audits and regulatory inspections and speeds up the review process.

Improve Customer Service

Insured individuals bring complicated situations and time-sensitive questions regarding policy matters or claims and coverage understanding. When knowledge management is organized effectively, agents and adjusters can instantly access current, precise data.

Excessive information creates difficulties for customers because 73% of them encounter information overload, but only 39% trust companies. A well-organized Knowledge Management System makes processes simpler because customers can understand their choices easily without facing frustration.

Simplifies Training and Onboarding

The intensive regulations, combined with the rapid changes in the insurance sector, make training and welcoming new employees into the organization highly difficult for insurance companies. A robust knowledge management system serves as a single vast resource for maintaining important information thus, it streamlines all learning activities. Here’s how:

New staff members gain entry to standardized training content incorporating FAQs, along with glossaries and step-by-step procedures to obtain precise and uniform information.

The trainee can advance at their speed through a properly organized knowledge repository by referring back to materials when necessary to maintain their learning.

Artificial intelligence systems in 2024 underwriting made senior underwriters focus on essential tasks by automating time-consuming procedures. Teaching new staff represents a persistent industry struggle because the workforce steadily ages.

The right to find solutions by themselves allows new hires to free their supervisors, who can then dedicate their time to strategic tasks.

A new adjuster gains quick claim processing skills by using detailed guides available in the knowledge base without relying on supervisor guidance. The process becomes faster while new employees develop more confidence and perform better due to it.

Key Knowledge Base Components Help Insurance Agents/Adjusters

The ability to access well-organized knowledge serves insurance agents and adjusters as their main tool to achieve greater efficiency and customer satisfaction along with improved accuracy. The insurance industry benefits from these essential components, which form the value of a knowledge base.

FAQs (Frequently Asked Questions)

Any knowledge base functions on the strength of its detailed Frequently Asked Questions section.

The software helps you create answers to typical day-to-day inquiries that customers, agents, and adjusters need about policies, claim filing rules, and compliance protocols. FAQ systems self-serve customers during onboarding and corporate time through direct responses, cutting down on the need for repeated information delivery.

For example:

- I need to file a claim as the representative of my client. What steps should I take?

- Which documents do the necessary policy renewal documentation consist of?

- What steps should I take when handling disagreements that arise while processing claims?

Regularly update your FAQs to demonstrate changes in regulations, internal processes, and related policies. This constant maintenance practice ensures that the updated content remains relevant and reliable.

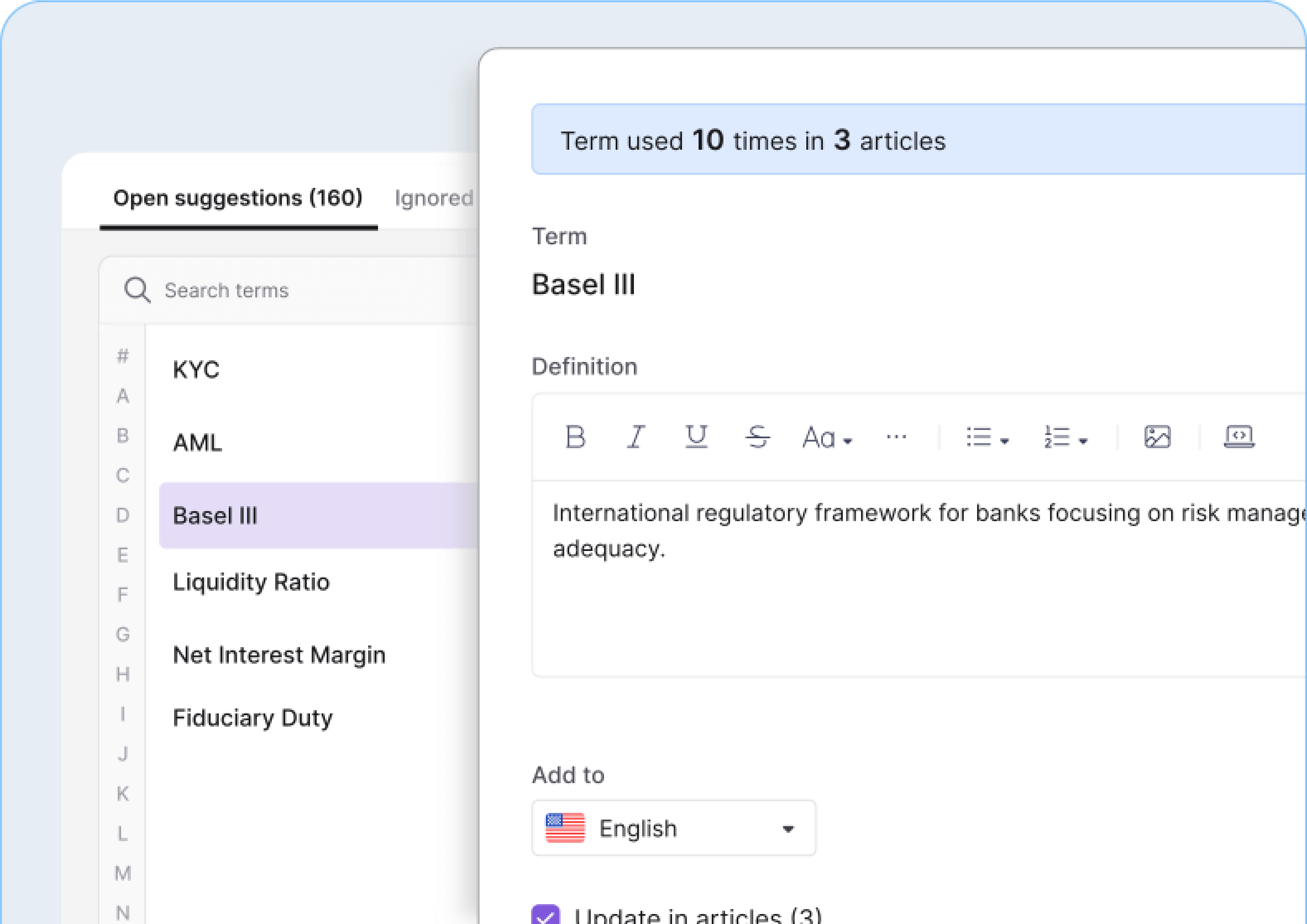

Glossary of Insurance Terms

The insurance field contains numerous specialized expressions, which makes understanding between insurance agents and their clients difficult. A glossary functions as an important communication tool since it defines essential terminology used in the industry. For instance:

- When insurance takes effect policyholders must pay their deductible, which is the initial costs they must cover themselves.

- Underwriters evaluate risks through their methodologies to create policy terms.

- Liability Coverage safeguards policyholders from paying damages caused by injuries or property losses to other people.

Glossary organization enables two key outcomes: helping everyone understand better while maintaining consistent team member-client exchange.

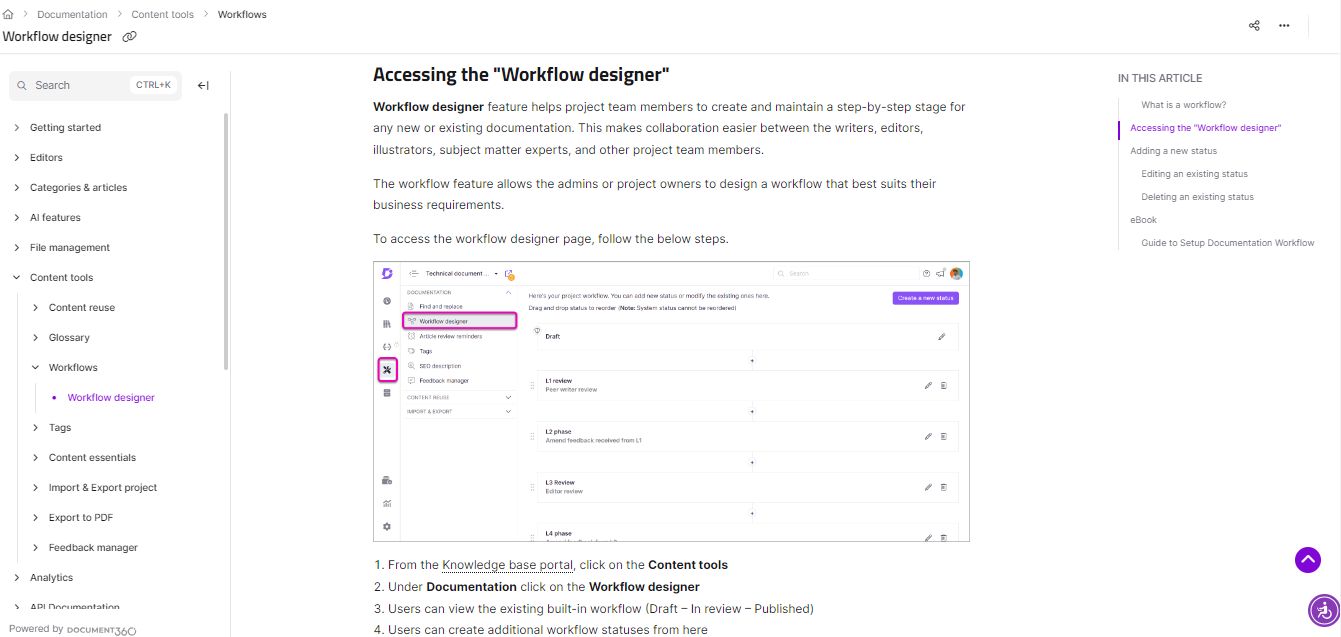

Step-by-Step Guides

Insurers face overwhelming situations with complex tasks, including claims submissions along with policy revisions or dispute resolution without clearly explained directions. The tasks become simpler through step-by-step guidance, which allows agents, along with adjusters, to perform actions without confusion.

For example:

How to Process a Claim:

- The agent must collect every required document from the client.

- Users must access the claims management system through their login interface.

- Send the claim after you have included all necessary evidence.

- Administrators track claims through the system to pass on important developments to clients.

Guides become clearer through the addition of visual elements such as flowcharts as well as screenshots.

Policy Comparison

The tool provides agents alongside adjusters with a system to compare multiple insurance policies seamlessly. The system keeps claims recommendations and processing accurate for staff members. Its benefits include:

- Side-by-Side Comparisons – Displays differences in coverage, exclusions, and premiums (e.g., Health Insurance Plans: Individual vs. Family Coverage).

- Faster Claim Assessment – Adjusters can verify coverage instantly, reducing claim processing time.

- Customer Guidance – Improves as agents use the system to explain policy differences accurately.

- Compliance Regulations – Ensures policies align with legal requirements.

- Automated Recommendations – Uses customer needs to provide optimal policy options.

The tool lets agents instantly compare travel insurance plans for theft protection when customers seek this information. The tool allows quick decisions while also increasing service transparency and producing better customer results.

Industry Updates and Compliance Information

Adjusters and agents continuously maintain their knowledge about market developments together with industrial regulations and compliance legislation. Alexa, Director of Training and Development at a finance company, says, “Document360 ensures people can find the information they are looking for in an industry where compliance is critical.” The system helps organizations meet state, federal, and international laws, including GDPR and consumer protection acts, thereby decreasing their legal exposure.

Through proper maintenance of KMS insurance companies can achieve both precision in their operations and secure themselves through legal protection while advancing the efficiency of their claims handling across the shifting insurance field.

Troubleshooting and Claim Assistance

Insurance agents and adjusters use structured, easy-to-access information for troubleshooting and claim assistance through the system. Guidelines within the system present necessary steps for policyholders alongside required claim documents, such as auto, health, and property claims.

When issues arise, the KMS offers common claim issue resolutions, explaining reasons for claim denials and troubleshooting tips for delays. It also clarifies policy coverage, helping agents distinguish covered vs. non-covered incidents.

For example, if an adjuster faces a coverage dispute, they can check FAQs, dispute resolution guides, and legal compliance policies, ensuring faster, more accurate claims processing and a better customer experience.

Schedule a demo with one of our experts to take a deeper dive into Document360

Book A Demo

How to Improve Insurance Agent/Adjuster Efficiency

Efficiency remains essential for insurance agents along with adjusters because they need to serve claims, policies and process customer inquiries swiftly but precisely.

Using Document360 knowledge base solutions, you can resolve problems that stem from outdated information while eliminating data errors and the absence of training and organizational silos.

By structuring documents in a central platform, all separated documentation becomes available through one unified interface.

Arlington/Roe implemented Document360 as a replacement for SharePoint files, which resulted in one unified system in which agents and adjusters can easily access their required resources instantly.

The system’s categorization and reader group segmentation tools allow users to see only important information, simplifying work processes and fostering team collaboration.

The use of outdated or incorrect data leads to cost-creating errors.

A knowledge base (KB) delivers review reminder features to maintain regular content and compliance updates. Agents/Adjusters can track version changes through the system to maintain information accuracy. The up-to-date step-by-step denial claim handling protocols are available in the KB for adjusters to use while following current policies.

Document360 offers an editor and, AI glossary generator alongside table-of-contents features, which enable companies to develop organized training materials through a user-friendly interface.

The use of visual aids through software tool screenshot examples helps to understand difficult processes better. New hires in agent and adjuster positions need shorter training times to master their roles while they simultaneously achieve higher job performance outcomes.

Staff members do not require support from IT teams or other departments for information now that they can access everything themselves, which results in better customer service delivery and more confident, efficient workforce operations

Features of Insurance Knowledge Base Software

The following list explains how essential system features facilitate their functions within insurance knowledge base software systems.

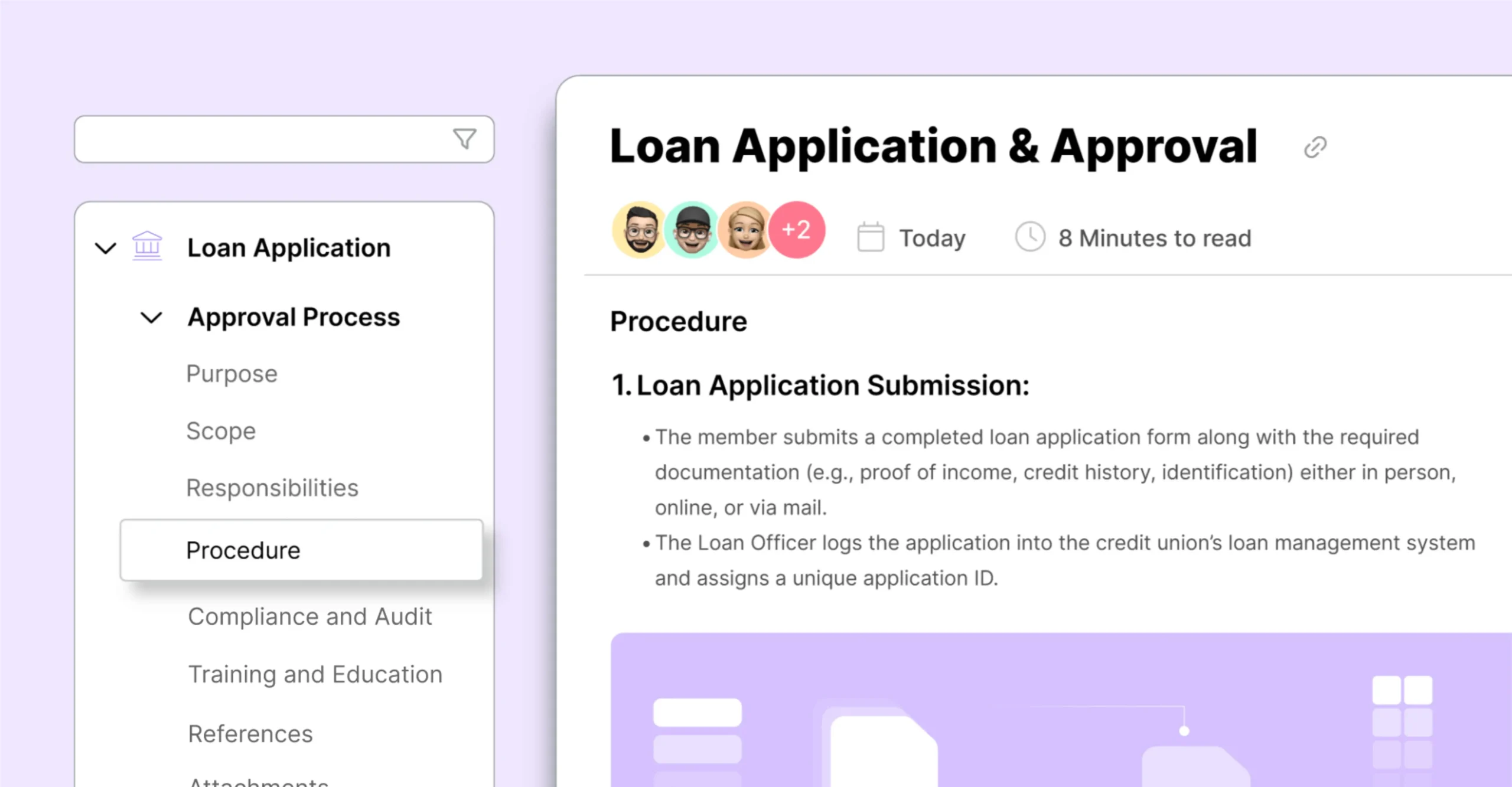

1. Centralized Storage for Insurance Documents and Policies

When information is not centralized, employees waste too much time searching for needed information resulting in delayed service along with incorrect information that produces poor customer experiences.

A unified organizational platform serves as the centralized knowledge base, ensuring simple access to classified insurance materials. Under the centralized system, employees acquire immediate access to accurate essential documents while experiencing no data segregation.

For example:

- The centralized knowledge base provides up-to-date claim processing guidelines to claims adjusters who no longer require outdated email attachments for guidance.

- Underwriters gain instant access to risk assessment templates through the system without requiring approval processes from other departments.

- Customer service teams experience quicker policy information retrieval, which shortens wait times while improving their service quality.

Also, the system maintains version control and runs automatic updates, which guarantees employees access to the latest information whenever a new regulatory policy becomes active, thus eliminating all risks of non-compliance.

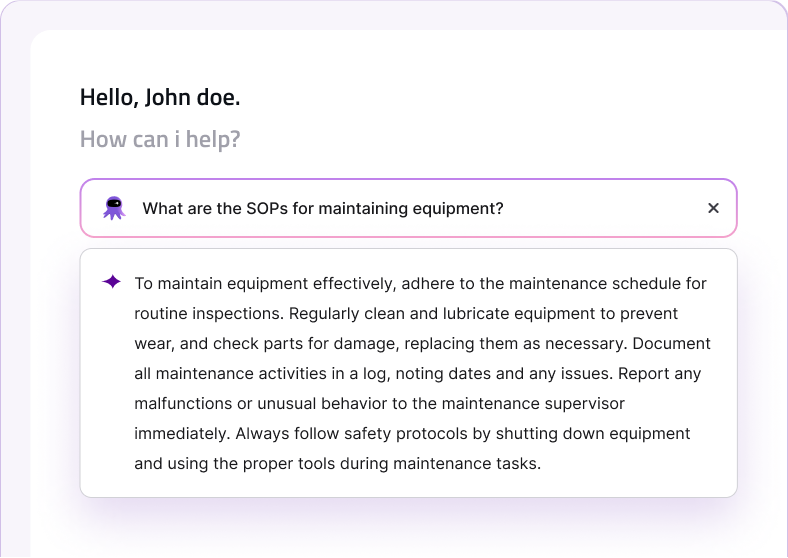

2. AI-Powered Search for Quick Access to Info

The AI-based search feature lets staff members obtain information by typing simple keywords through a rapid search method.

With AI-driven search:

- Employees can access answers to their health insurance wait period questions by typing “What’s the waiting period for health insurance claims?

- The system organizes information according to usage history data so staff members can easily retrieve their most frequently needed materials.

3. Real-Time Updates on Compliance and Regulations

Non-compliance with changing insurance regulations leads to legal fines and negative company standing, and it exposes the organization to financial risks. The knowledge base system provides reduced-time updates that supply every employee with current compliance needs.

Let’s say a new government policy mandates additional fraud checks for auto insurance claims. The system’s knowledge base automatically updates information, triggering rapid notifications to reach all claims adjusters.

This feature helps insurers:

- Safeguards itself from regulatory penalties by maintaining employee adherence to present guidelines.

- It replaces the need for manual updates from compliance officers, so they no longer need to perform individual email distributions or document disseminations.

- All departments receive precise, current information, which leads to enhanced transparency as employees gain clear access.

4. Easy Integration With CRM and Policy Systems

Insurance organizations operate with an array of different technological systems that consist of both CRM’s, policy management tools, claims processing software, and customer service technology.

The inability of knowledge bases to synchronize with other business tools forces employees to switch between separate applications when retrieving information.

For example, a single integrated system enables customer representatives to handle policy-related inquiries by doing the following:

- Gains immediate access to both customer profiles and their policy details.

- Permits users to locate relevant knowledge base articles appropriate for their present search query.

- The system automates the recording process of customer interactions together with their resolution points, which enables representatives to avoid doing repetitive work.

The unified systems platform leads to efficient workplace operations which reduce customer service times and produce greater customer satisfaction results.

5. Secure Access Control Based on Roles

An insurance company’s entire data system must not grant full access to each staff member. Claim interpretation details are essential for adjusters, while policy records are the only authorized information for agents who serve customers. The absence of proper access controls allows data leaks to unauthorized hands leading to data breaches alongside non-compliance infractions.

With role-based access control:

- High-risk fraud detection reports remain accessible to managers because they contain information of a sensitive nature.

- The system enhances operational performance by presenting relevant information to staff according to their workplace responsibilities, thus reducing work-related confusion.

- The system improves compliance and security through user interface monitoring features. These track document access and editing, as well as automatic audit logging.

6. Scales as Your Business Grows

When insurance enterprises expand operations, they encounter more challenges with policy management, claim processing, insurance regulation maintenance, and customer relationship maintenance. Knowledge-based software that lacks proper scalability will eventually develop into a slow and hard-to-manage system.

A scalable system:

- Works effectively during data increase periods that accompany business growth.

- Enables hassle-free integration with new business tools that are adopted in the future.

- Maintains flexibility to accommodate various departments and employees under different workflow conditions while avoiding replacement of the entire system.

For instance, midsize insurance businesses operating with less than 50 staff members do not need complex artificial intelligence functionality to begin their operations. The company needs to enable multiple language capabilities as they expand to 500 workers in different locations and must develop personalized workflows and advanced analytical capacity. The ability for knowledge bases to accept new requirements should exist without causing operational interruptions to the system.

Conclusion

Insurance knowledge management systems directly improve operational efficiency and enhance compliance requirements along with the delivery of customer satisfaction.

The insurance industry, at both its small and large scales, can use Document360 to create a unified knowledge hub. Your team will achieve greater success through an easy-to-use centralized knowledge base platform that Document360 can develop for your organization.

Frequently Asked Questions

1. How does knowledge management improve efficiency for insurance companies?

Efficiency increases because knowledge management centralizes information while simultaneously cutting down inefficiencies and optimizing operational processes. Workers gain immediate access to the right current information, which reduces their time needed to perform searches or correct mistakes. The system enables agents to access policy information and claim procedures quickly, therefore providing faster service to customers and maintaining efficient operations.

2. How does knowledge management help with regulatory compliance in insurance?

Through knowledge management, all regulatory requirements, guidelines, and updates become reliably documented for immediate accessibility. A centralized database for compliance information within insurance companies helps the organization avoid non-compliance incidents while enforcing continuous adherence to regulations.

3. What are the benefits of knowledge management for insurance agents and adjusters?

Knowledge management delivers immediate access to vital resources that comprise FAQs, glossaries, and step-by-step guides to agents and adjusters. Staff members achieve higher efficiency in handling customer questions, claim processing, and problem-solving. This system enables continuous learning and standardized services, resulting in higher productivity levels and superior customer satisfaction.

–

–